Imagine a mid-sized bank overwhelmed with millions of transactions, thousands of loan applications, and tens of thousands of customer queries every day — all demanding lightning-fast decisions and razor-sharp accuracy. The stakes couldn’t be higher: a single missed fraud alert or a delayed credit decision could cost millions or destroy client trust overnight.

This is the reality fintech faces, and it’s why Agentic AI has emerged as a game-changer. Today, financial institutions wield AI not only to automate routine tasks but to drive complex decisions, personalize client experiences at scale, and navigate turbulent markets in real time.

Table of Contents

Why Agentic AI Matters in Financial Services — By the Numbers

According to recent studies, AI adoption in financial services has grown by over 70% in the last three years, with the global AI in fintech market projected to reach $26 billion by 2027, growing at a CAGR of 23%. Firms investing in advanced AI systems report a 30-40% improvement in operational efficiency and significantly faster turnaround times on credit decisions, compliance checks, and customer service.

These statistics represent measurable impact across the financial ecosystem, from retail banking to asset management:

- 70% of financial firms have integrated AI into at least one business function, primarily fraud detection and customer service (Source: Deloitte).

- AI-driven credit assessments reduce loan default rates by up to 25% through better risk profiling (Source: McKinsey).

- Automated transaction monitoring powered by AI can detect suspicious activity with 95% accuracy, cutting false positives by 50% (Source: Accenture).

- Firms using AI for customer engagement report up to 20% increase in client retention thanks to personalized financial coaching and real-time advice (Source: PwC).

The financial industry saves an estimated $447 billion annually through AI-enabled automation in compliance and operational tasks (Source: Business Insider Intelligence).

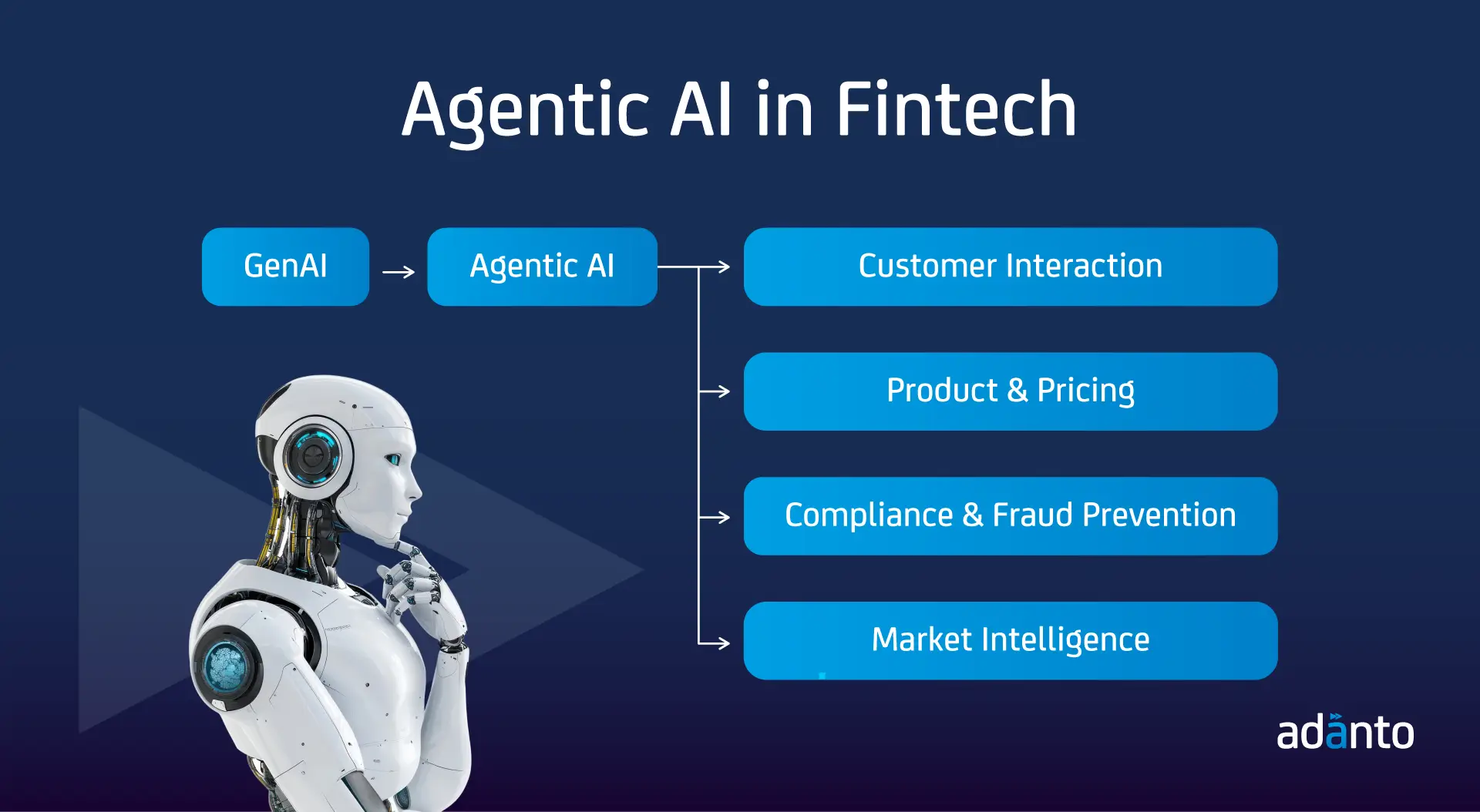

Use Cases of Agentic AI in Financial Services

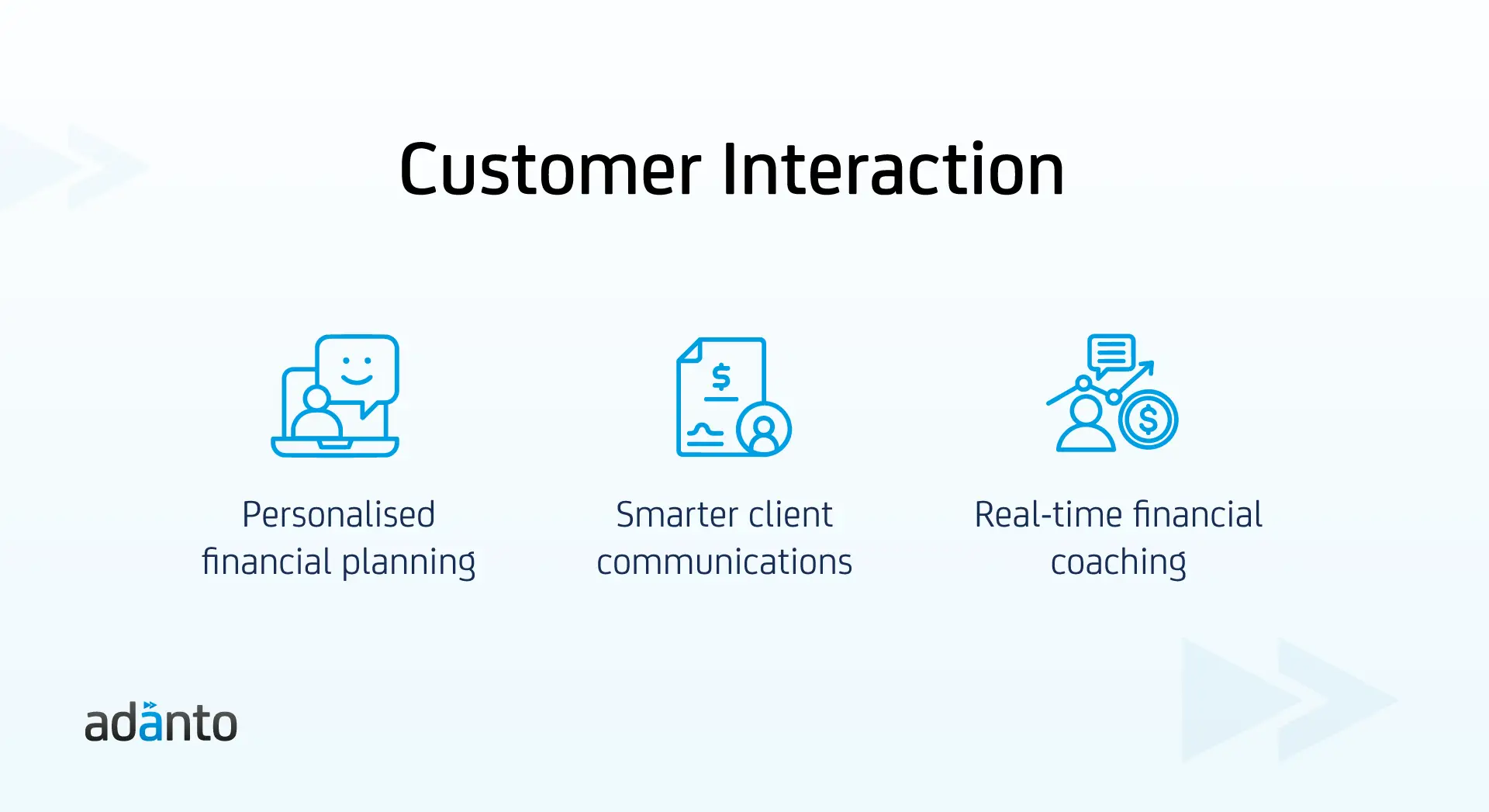

Enhancing Customer Interaction

In a sector where customer trust and engagement are paramount, Agentic AI transforms how firms interact with their clients.

- Client Engagement: Agentic AI automates personalized financial planning tools, creating tailored app interfaces that adjust dynamically to individual client profiles and needs.

- Relationship Management: By optimizing communication channels and tailoring engagement strategies, financial institutions can maintain stronger client relationships and increase satisfaction.

- Personal Financial Advisory: Real-time coaching and financial advice based on clients’ spending patterns enable more proactive and relevant financial guidance.

This not only improves client experiences but also drives loyalty and retention.

Innovating Product and Pricing Strategies

Agentic AI enables smarter product offerings and dynamic pricing models, giving firms an edge in competitive markets.

- Credit Assessment & Loan Origination: AI evaluates creditworthiness with higher precision, customizes loan offers, and autonomously manages portfolios with high-risk profiles, reducing defaults and improving underwriting efficiency.

- Dynamic Pricing: Pricing models adjust in real time according to client behavior, market conditions, and risk factors, optimizing retention offers and revenue.

Such adaptability results in more competitive, customer-centric products.

Strengthening Compliance and Fraud Prevention

Regulatory compliance and fraud detection are among the most complex and critical challenges for financial firms. Agentic AI excels in these areas by continuously monitoring and reacting to emerging threats.

- Transaction Monitoring: Detects anti-money laundering (AML) risks by flagging suspicious transactions and dynamically intervening before damage occurs.

- Claims and Underwriting: Automates triaging processes and refines risk models to improve accuracy and speed.

- Financial Risk Surveillance: Tracks market threats in real time and recommends mitigation strategies.

- Software Compliance Testing: Identifies bugs, ensures regulatory compliance, and deploys seamless updates.

- Process Automation and Quality: Triages complaints efficiently and detects operational anomalies to maintain service excellence.

By automating these critical processes, Agentic AI helps reduce operational costs and mitigate legal and reputational risks.

Driving Market Intelligence and Competitive Advantage

Agentic AI empowers financial institutions with deeper market insights and strategic agility.

- Competitive Market Analysis: Continuously tracks competitor strategies and uncovers actionable insights for tactical decision-making.

- Market Trend Surveillance: Monitors shifts in the financial landscape, alerting analysts to emerging risks or opportunities early.

This intelligence supports proactive strategy development and faster response to market changes.

Conclusion: Why Financial Firms Can’t Afford to Ignore Agentic AI

Financial services face increasing pressure from tighter regulations, rising customer expectations, and intense competition. Agentic AI is proving to be a vital tool that drives faster decisions, improves risk management, and personalizes customer experiences at scale.

The data is clear: firms using Agentic AI gain real advantages in efficiency and retention. Those that hesitate risk falling behind more agile competitors.

Want to use AI in your business?

Get in touch with the Adanto Software Team today to see how we can help.