In 2024, global fraud losses reached $485 billion, with digital payment fraud rising by 18% year-over-year. The fraud landscape is evolving fast—driven by automation, AI-assisted scams, and synthetic identities. Traditional fraud detection systems struggle to keep pace, largely because they rely on rule-based logic and reactive human workflows.

To respond in real time, organizations need systems that can act on their own. This is where autonomous AI agents come into play. These agents don’t just identify fraud—they execute decisions, trigger actions, and evolve with each case they process. In short, they operationalize intelligence at machine speed.

In this article, I’ll explain how these agents work, what they’re capable of, and where they’re already delivering measurable impact — particularly in financial services, insurance, and e-commerce.

Table of Contents

What Is an Autonomous AI Agent?

Autonomous AI agents are software entities that can perceive data, reason over it, make decisions, and take actions—without human intervention. These agents typically combine:

- Real-time data ingestion

- Machine learning (often anomaly detection, clustering, or reinforcement learning)

- A decision-making engine

- A trigger mechanism (e.g., blocking, alerting, escalating)

Unlike static ML models embedded in a rules-based system, autonomous agents are built for continuous operation. They interact with other systems, manage workflows, and adapt based on outcome feedback.

Why Traditional Fraud Detection Falls Short?

Most fraud detection pipelines today are reactive:

- Transactions are scored based on predefined thresholds

- Alerts are queued for review

- Analysts triage cases manually

- Action is taken hours or days later

This approach introduces delays, fatigue, and inconsistency. Worse, fraudsters exploit these weaknesses with rapid attacks that mimic normal behavior. Static systems can’t detect these dynamic patterns fast enough—and they certainly can’t respond in real time.

How Autonomous Agents Address the Gap?

Autonomous agents are designed to close the decision-action loop. Here’s how:

- Continuous monitoring: They evaluate live data streams rather than periodic batches.

- Pattern learning: They learn over time—detecting not just known fraud, but emerging anomalies.

- Decision execution: They act immediately—freezing accounts, flagging claims, or launching investigation workflows.

- Feedback loops: They learn from past actions, enabling them to refine future decisions.

Agents can also operate across systems—integrating with CRMs, payment processors, document repositories, and third-party data providers.

Key use cases and results

Let’s explore where autonomous agents are already in use, and what kind of value they’re delivering.

Financial Services – End-to-End Case Handling

A credit union partnered with Accelirate to streamline its fraud operations. An AI agent was deployed to:

- Check transactions across Symitar and Extranet

- Match against historical behavior

- Eliminate duplicates

- Trigger escalation workflows

Results:

- 657 analyst hours saved annually

- 98% reduction in processing errors

- $19,800 in direct cost savings

Insurance – Claims Fraud Detection

An insurer used an agent to review low-dollar claims submitted within short timeframes across multiple user profiles. The agent:

- Flagged matching metadata and document reuse

- Pulled historical claims from different user IDs

- Auto-generated fraud reports for the investigation team

Results:

- 245% ROI within the first year

- $320,000+ in savings

- 62% reduction in claim resolution time

E-Commerce – Loyalty Abuse Prevention

Retailers are increasingly targeted by bot-driven attacks—fake signups, coupon abuse, and identity farming. AI agents can:

- Detect fake account clusters (shared IPs, browser fingerprints, timing anomalies)

- Flag attempts to exploit loyalty programs

- Pause reward disbursement and notify risk teams

Impact: Fewer false positives than rules-based systems, with real-time enforcement and reduced operational load on fraud teams.

Fintech Lending – Synthetic Identity Detection

Fintech lenders deal with high volumes and thin data. One client used agents to catch applications that:

- Used slightly altered identity data (e.g., different DOB or SSNs with matching addresses)

- Applied to multiple loan products in rapid sequence

- Reused documents across supposedly unrelated accounts

The agent connected the dots and auto-rejected risky applicants before credit was issued.

Known Challenges And Risks

No system is perfect. There are trade-offs to consider:

- Explainability: Deep-learning agents can make decisions that are hard to justify without traceable logic. This is a concern for regulated industries.

- Bias: If agents are trained on biased data, they may reinforce discrimination (e.g., falsely flagging users based on geography or demographic patterns).

- Overreach: Agents acting too aggressively (e.g., false account freezes) can damage user trust and create compliance risks.

To mitigate these, agents should be built with human-in-the-loop oversight, audit trails, and risk thresholds that define when automation is allowed to act independently.

What To Expect Going Forward

Autonomous AI agents will evolve beyond single-use cases. We’re seeing early adoption of multi-agent systems, where:

- One agent focuses on transaction-level fraud

- Another monitors identity risk over time

- A third handles response orchestration and user communication

This layered approach builds resilience and adaptability.

We’re also likely to see closer integration with identity verification, KYC, behavioral biometrics, and external fraud intelligence feeds.

Conclusion

Autonomous agents are not silver bullets. But they are a necessary shift. As fraud tactics grow more automated, detection and prevention must move at the same pace.

The true value of these agents isn’t just speed—it’s consistency, scalability, and reduced human burden. In areas like fintech, e-commerce, and insurance, the business case is already clear.

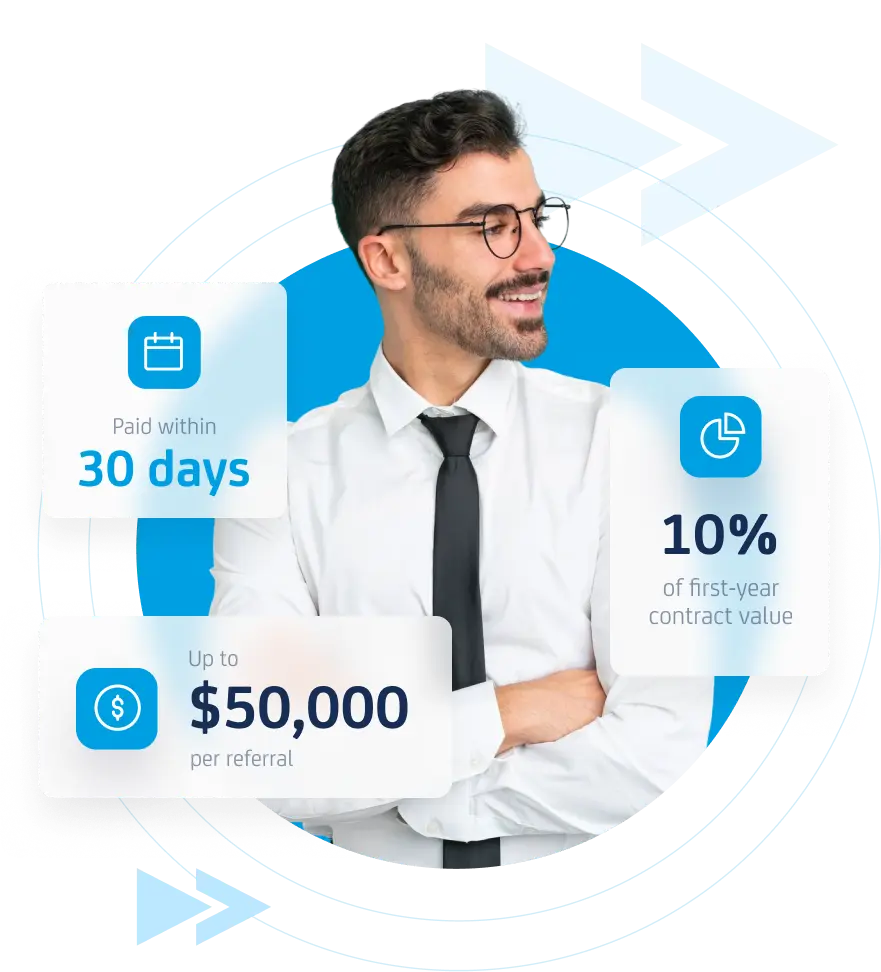

Want to use AI in your business?

Get in touch with the Adanto Software Team today to see how we can help.