Imagine you’re the head of a major financial institution. It’s a busy day, with countless transactions happening in real-time. You need to make a critical decision about a new lending product, but you have no real way of understanding who your best customers are or what risks are involved. The data is all there, but it’s scattered across different systems, incomplete, and impossible to analyze quickly. This was the reality for many in finance not so long ago.

Today, that scenario is unthinkable. Fintech has changed everything. The reason is simple: data analytics. Data analytics is the fundamental force driving innovation, efficiency, and security in the financial technology sector. It’s the difference between guessing and knowing, between reacting and predicting.

Table of Contents

From Intuition to Insight: The Core Shift in Finance

Historically, many financial decisions were based on intuition, historical precedents, and a limited set of data. Loan officers used personal judgment, and risk was assessed using simple, static models. This approach was slow, prone to human error, and couldn’t keep pace with the modern global economy.

Data analytics has changed this by providing a framework for making decisions based on evidence. It allows fintech companies to collect vast amounts of data—from transaction histories and credit scores to social media activity and online behavior—and process it to find patterns and trends. This enables a shift from a reactive to a proactive approach, where companies can anticipate customer needs, predict market shifts, and identify fraudulent activity before it occurs.

Consider the lending sector. A recent study by Statista found that by 2026, the global fintech market will reach a valuation of $324 billion, with data analytics as a key driver. This growth is directly tied to new capabilities. For instance, data analytics allows lenders to create more accurate credit risk models. They can assess a borrower’s creditworthiness using thousands of data points, not just a few. This leads to better-informed decisions, lower default rates, and the ability to offer credit to individuals and small businesses who might have been excluded by traditional methods.

How Data Analytics Powers Fintech

Data analytics works by ingesting raw data from various sources, processing it, and then using algorithms to extract meaningful insights. This process can be broken down into a few key areas:

1. Customer Segmentation and Personalization:

Fintech companies use data analytics to understand their customers better. By analyzing spending habits, demographic information, and digital interactions, they can segment their customer base into different groups. This allows for the creation of personalized products and services, such as a tailored savings plan for a young professional or a specific investment portfolio for a retiree. Personalization isn’t just a nice-to-have feature; according to a report by Accenture, 91% of consumers are more likely to shop with brands that provide relevant offers and recommendations.

2. Fraud Detection and Security:

In the world of finance, security is paramount. Data analytics plays a critical role here. By continuously monitoring transaction data in real-time, algorithms can identify unusual patterns that may indicate fraudulent activity. For example, if a credit card is suddenly used for a large purchase in a different country, the system can flag it and automatically alert the cardholder. This reduces financial losses and builds customer trust. The Identity Theft Resource Center reported that in 2023, data breaches reached a new record high, underlining the need for sophisticated fraud detection tools.

3. Risk Assessment and Management:

Risk is inherent in finance, but data analytics makes it manageable. By analyzing market data, transaction patterns, and credit histories, fintech firms can create dynamic risk profiles. This helps them make smarter decisions about everything from setting interest rates to approving loans. The result is a more stable and resilient financial system.

4. Operational Efficiency:

Beyond direct customer services, data analytics optimizes internal operations. It can automate tasks like compliance reporting, streamline customer support by predicting common issues, and improve product development by identifying areas for improvement based on user behavior. This reduces costs and allows companies to scale more effectively.

The Future of Fintech is Data-Driven

The integration of data analytics with other technologies like machine learning and artificial intelligence is creating a new wave of innovation. Predictive analytics, for example, is helping companies forecast market trends and customer behavior. This capability moves companies from being reactive to proactive, allowing them to gain a significant market advantage.

The industry is also seeing a shift towards embedded finance, where financial services are integrated directly into non-financial products or platforms. This creates new streams of data that, when analyzed, provide even deeper insights into customer behavior. For example, an e-commerce platform could analyze purchasing data to offer instant financing options at the point of sale.

A recent PwC report highlighted that 88% of traditional financial institutions are concerned they may lose business to fintech companies. This concern is valid, and it’s largely driven by the agility and data-driven approach of fintechs. They can build better products, provide superior customer experiences, and manage risk more effectively, all because they use data as their core asset.

Conclusion

Let’s be clear: the time for considering data analytics is over. For any business in the financial world, data is not just a tool—it’s the foundation. We’ve seen how it can be used to understand customers on a deeper level, to protect against fraud in real time, and to manage risk with far greater precision than ever before. It’s what separates the industry leaders from those who are simply trying to keep up.

Think about the sheer amount of information we generate every second. Every transaction, every login, every search for a new product. That data holds the key to building smarter, more resilient financial services. The companies that will dominate the market in the coming years are the ones that don’t just collect this data, but actively turn it into a competitive advantage. They will use it to create products people actually need and to build the trust that keeps them coming back.

The good news is that the technology is here. The real challenge is in the mindset. It’s about moving past old habits and embracing a new, data-driven culture. It means asking a different set of questions and making decisions based on evidence, not just instinct.

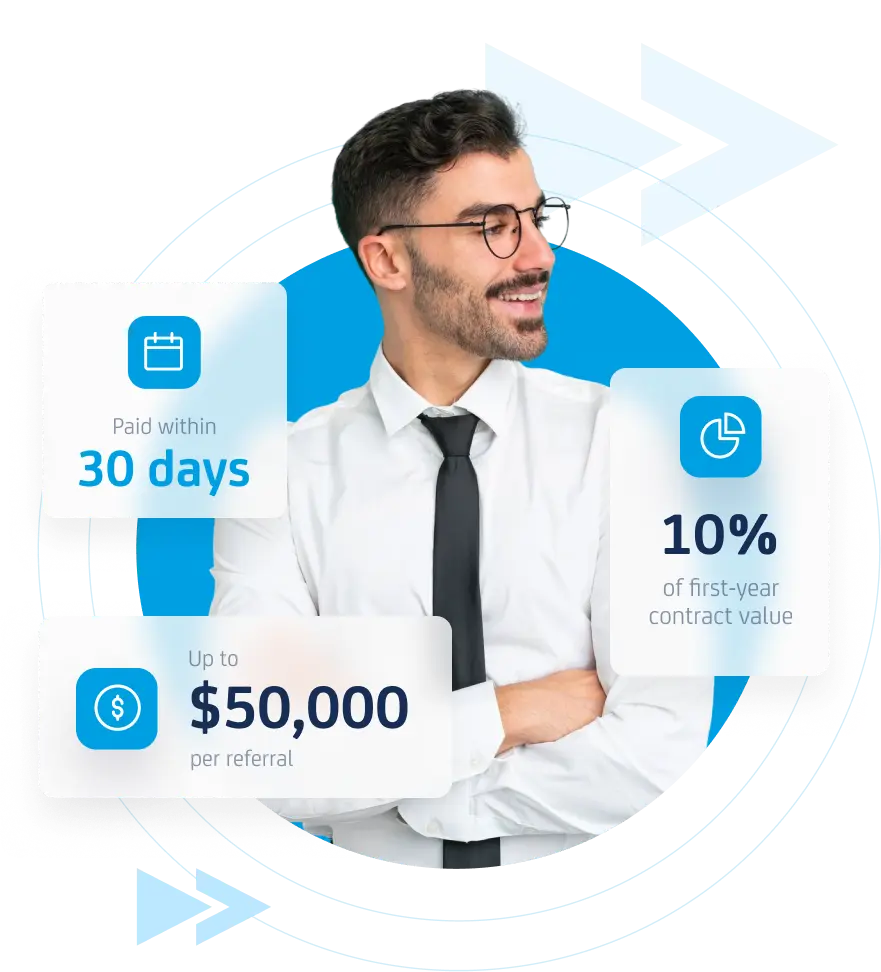

At Adanto Software,

we specialize in building robust and scalable software solutions for the Fintech industry. We help our clients leverage the power of data analytics to innovate and grow. To learn how we can help your business, contact us.