We are at an inflection point in finance. The conversation has shifted from “what if” to “how fast.” For executives and decision-makers, the mandate is clear: embrace the technological revolution or risk being left behind. The future of the financial industry is being built on three pillars—the proliferation of digital payments, the transformative power of artificial intelligence, and the fundamental shift to the cloud. This isn’t just a matter of staying competitive; it’s about securing a position of leadership in a new financial landscape.

Table of Contents

The Era of Digital Payments: When Convenience Becomes a Competitive Differentiator

By 2025, digital payments are projected to account for nearly 80% of all global transactions. This is a staggering figure, but the real story is in the impact it has on the customer journey. Consumers and businesses alike now demand a frictionless experience. They expect to pay with a tap, a click, or a glance, and they have zero tolerance for clunky interfaces or security concerns.

Consider the domino effect of a poor payment experience. A frustrating checkout process online can lead to abandoned carts and lost revenue. In-store, a slow or unreliable point-of-sale system can create long lines and tarnish a brand’s reputation. The solution is not just about accepting different forms of payment; it’s about integrating a cohesive, secure, and intuitive payment ecosystem. This includes everything from mobile wallets and contactless cards to instant peer-to-peer transfers and B2B digital invoicing. The companies that get this right are not just optimizing a single process—they are building a foundation of trust and convenience that drives customer retention and market share.

Artificial Intelligence: The Trillion-Dollar Opportunity in Automation and Insight

Artificial intelligence is no longer a futuristic concept—it’s a critical tool for operational excellence and strategic growth. Financial institutions are on track to save over $70 billion by 2025 by leveraging AI to automate back-office tasks and streamline operations. But the value extends far beyond simple cost savings. AI is fundamentally changing how financial institutions manage risk, engage with customers, and detect fraud.

On the efficiency side, AI and machine learning can process and analyze vast datasets in real time, automating tasks that were once time-consuming and prone to human error. This includes everything from sifting through thousands of loan applications to performing complex credit risk assessments. AI-powered chatbots and virtual assistants are handling up to 80% of routine customer inquiries, allowing human agents to focus on more complex, high-value interactions.

From a strategic perspective, AI provides a level of insight that was previously unattainable. Predictive analytics can forecast market trends, identify new revenue opportunities, and personalize product offerings with a precision that was once confined to sci-fi. For example, by analyzing a customer’s spending habits and financial history, an AI system can proactively suggest relevant financial products or personalized savings plans. In the battle against fraud, AI models can detect anomalous transactions in real-time, preventing financial crime before it happens. This isn’t just about catching bad actors; it’s about protecting the integrity of the entire financial system.

Cloud Computing: The Engine Driving Agility and Innovation

The move to the cloud is perhaps the most foundational shift in modern finance. The numbers are clear: a significant majority of financial services firms, around 90%, are projected to have adopted cloud technology by 2025. The reasons are a powerful mix of security, flexibility, and cost-effectiveness.

Legacy on-premise systems are inherently rigid and expensive to maintain. They require significant capital expenditure, constant manual updates, and are not designed to scale with the dynamic demands of the market. Cloud infrastructure, in contrast, offers a pay-as-you-go model that allows firms to scale up or down as needed, without the burden of managing physical servers. This agility is a game-changer. A cloud-native bank can launch a new service in weeks instead of months, instantly responding to a market opportunity or a competitor’s move.

Beyond cost and scalability, the cloud is also a prerequisite for leveraging modern technologies like AI and machine learning. The computing power required for sophisticated AI models is best delivered through scalable cloud platforms. Furthermore, cloud environments, when configured correctly, offer enhanced security and disaster recovery capabilities. By distributing data across multiple centers and employing advanced encryption, cloud providers can offer a level of resilience that few individual firms can match on their own. The cloud is no longer just a place to store data; it’s the core operating system for the next generation of financial innovation.

A Strategic Blueprint for the Future

The convergence of these three trends—digital payments, AI, and cloud adoption—is not a series of independent decisions. They are interconnected elements of a single strategic blueprint. A business cannot fully capitalize on the power of AI without the flexible, scalable infrastructure of the cloud. And it cannot build a truly competitive customer experience without a seamless digital payment platform.

The challenge for leaders is to move past incremental changes and embrace a holistic transformation. This means investing in talent, rethinking operational processes, and, most importantly, partnering with technology providers who understand the unique demands of the financial sector. The window of opportunity is open, but it won’t be forever.

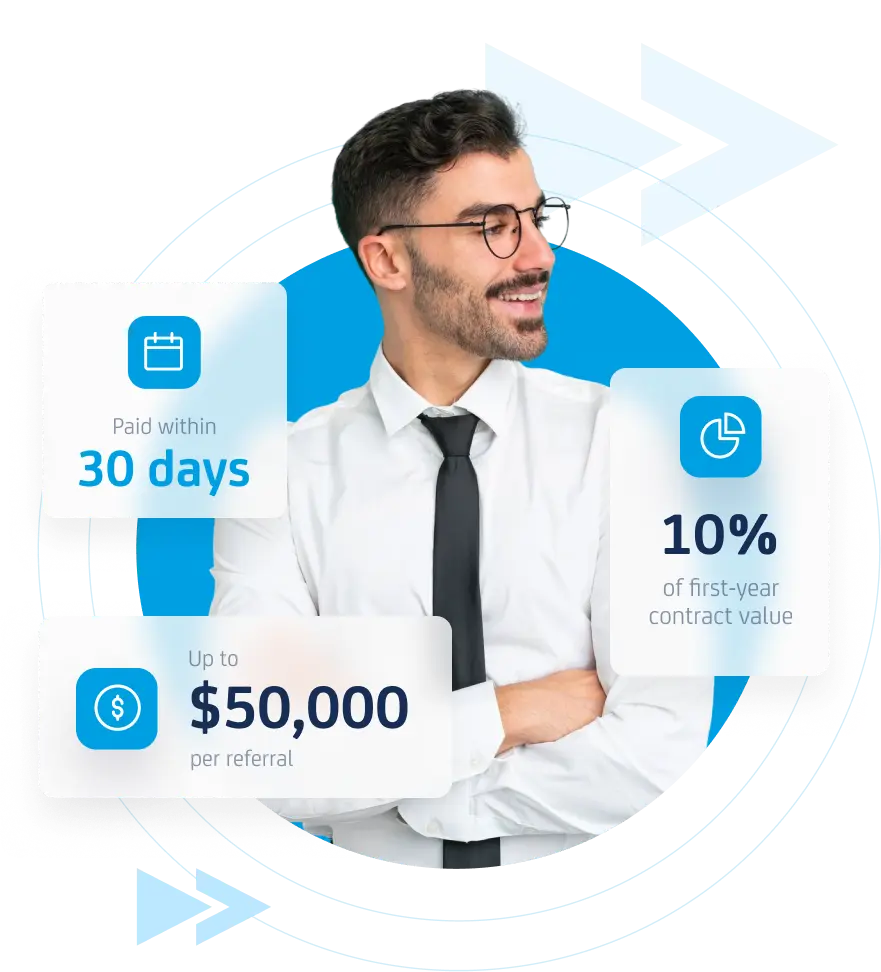

At Adanto Software,

we specialize in building the systems that power the financial industry’s future. Our expertise in cloud architecture, AI-driven solutions, and payment platforms is designed to help your business not just keep pace with change, but to lead it. To learn more about how we can accelerate your transformation, contact us today.