Financial socialization is no longer a matter of piggy banks and passbooks. For Generation Alpha — a demographic projected to be the largest in history—money is purely digital and inherently social. As these “digital natives” age into their prime spending years (holding $360 billion in current influence), traditional banks face a “relevance gap.” Static mobile apps are being outperformed by gamified ecosystems that reward micro-habits in real-time. This analysis explores how Adanto Software’s engineering of event-driven architectures allows banks to transition from passive utilities to active lifestyle partners, securing the foundational layer of the next generation’s loyalty.

Table of Contents

The Psychology of the Interactive Ledger

Gen Alpha does not view money as a physical asset but as a digital entry in an ecosystem. To them, a savings account without feedback feels broken. Traditional banking relies on delayed gratification — waiting a month for a few cents of interest. Gamification replaces this with “Variable Rewards” and immediate feedback loops.

When a user reaches a savings milestone and receives a digital “level up” or unlocks a new custom app theme, the brain releases dopamine. This creates a positive association with fiscal responsibility. But this isn’t just about fun. It is about building muscle memory. By rewarding “streak” behaviors—like saving five dollars every week for a month — banks can program the foundational habits that lead to high-value adult customers.

Engineering Real-Time Rewards

The biggest hurdle for most banks isn’t the idea; it’s the execution. Most legacy core banking systems are batch-processed, meaning data is updated in chunks, often overnight. You cannot gamify an experience if the “reward” for a purchase shows up 24 hours later.

Adanto Software’s engineers solve this through Event-Driven Architecture (EDA). Instead of waiting for a batch update, our integration layer listens for specific “events” on the ledger in real-time.

When a child taps their debit card, the system triggers a sequence:

- The Event: A transaction is authorized.

- The Filter: Was this a “Round-Up” transaction for a savings goal?

- The Action: If yes, the API instantly updates the “Family Wallet” interface to show a progress bar moving 2% closer to a goal.

This real-time synchronization requires a robust API gateway that sits between the modern front-end and the legacy back-end. Adanto’s role is ensuring these two worlds communicate without latency, ensuring the “game” feels responsive and reliable.

Why Passive Banking Is a Sunk Cost

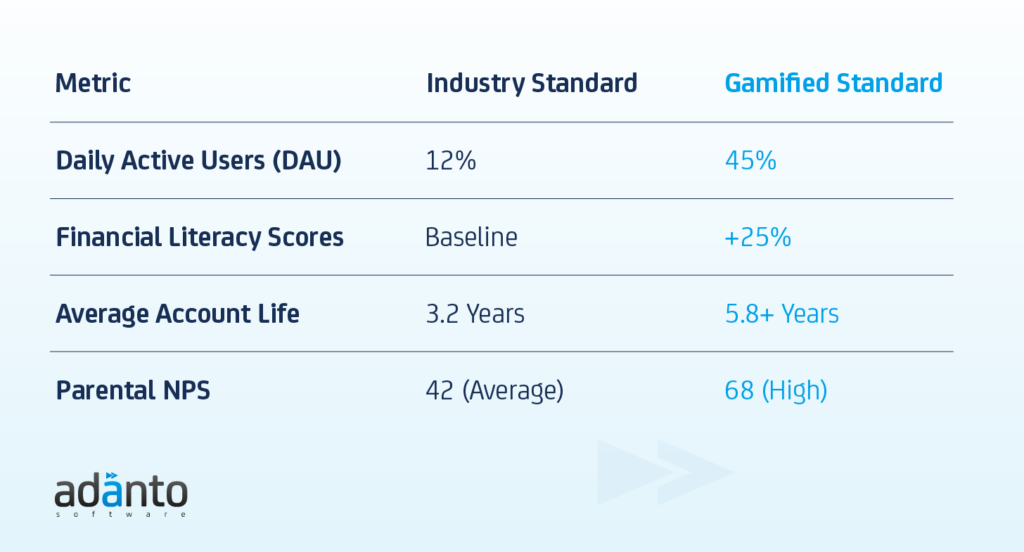

The market shift is documented in the diverging ROI of static versus digital-first platforms. Traditional “passive” banking — where the relationship is defined by a monthly statement and occasional transaction — is rapidly becoming a liability for growth-oriented institutions. The data reveals that high-engagement features, specifically those incorporating gamified mechanics, transform the fundamental economics of the customer relationship.

By moving from a reactive utility to an interactive habit, banks see a 275% increase in Daily Active Users (DAU) and nearly double the average account life. This stickiness is driven by a superior Parental Net Promoter Score (NPS) of 68, reflecting a clear market demand for platforms that offer proactive value rather than just a digital vault.

Integration Strategies for Legacy Core Systems

A common executive concern is that modernizing the user experience requires a full core replacement. It doesn’t. We advocate for a decoupled microservices approach. By keeping the “game logic” separate from the regulated “banking logic,” we ensure that updates to the rewards system never compromise the security of the ledger. This “sandbox” approach allows for rapid iteration — crucial for a generation whose tastes change quarterly.

Strategic recommendations for Financial Leaders:

- Prioritize Micro-Wins: Shift focus from $500 goals to $5 milestones. Small wins generate higher retention.

- Embed Learning into the Transaction: Use “Just-in-Time” education. If a transaction is declined, the app should offer a 10-second interactive budgeting tip rather than a generic error code.

- Partner for Speed: Use specialized integration partners like Adanto Software to handle the API architecture, freeing your team to focus on brand and community.

Conclusion

Generation Alpha isn’t looking for a static vault; they want a digital experience that rewards their attention in real-time. To bridge the “relevance gap,” banks must move beyond being a passive utility and become an interactive habit. If your interface feels like a chore, this generation will simply find one that feels like a win.

The hurdle isn’t vision — it’s the aging “plumbing” of legacy systems. Adanto Software provides the engineering muscle to connect old-school security with the real-time speed of event-driven architecture. By turning banking into a series of responsive, winning moments, we help institutions stop acting like utilities and start acting like the high-speed tech partners their future customers already expect.

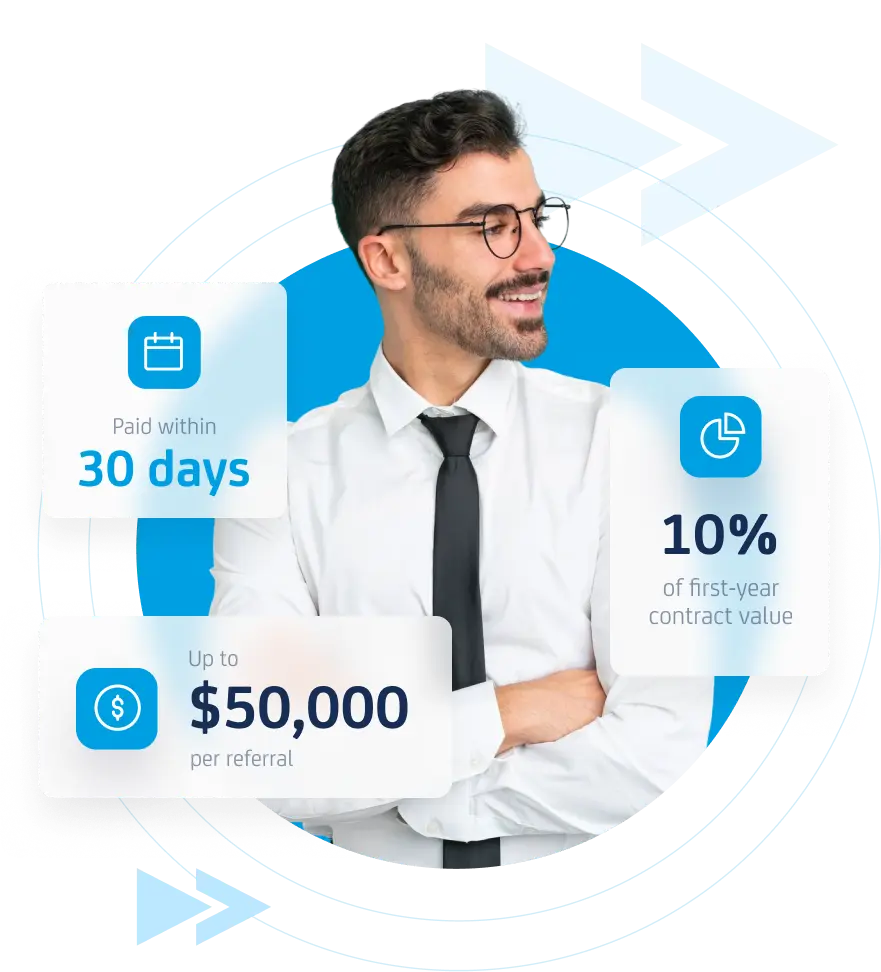

Developing for

the next generation?

Consult with our Fintech experts to see how we can integrate secure youth banking into

your existing portfolio.