Main page > Case studies > Data Services > Adanto Boosts Service & Cuts Costs with Big Data Analytics

Robert Half

www.roberthalf.com

Adanto Boosts Service & Cuts Costs with Big Data Analytics

Adanto’s Real-Time Big Data Analytics solution streamlined operations for a global HR leader, cutting abandoned calls from 18% to 5%, reducing hold times to 4 minutes, and enhancing real-time insights with advanced reporting and dashboards.

![]() Really happy with Adanto’s work and your engineering capabilities in the C#/.Net back end development of our LSX platform. Our team has voted very high marks and would like to keep utilizing your services.

Really happy with Adanto’s work and your engineering capabilities in the C#/.Net back end development of our LSX platform. Our team has voted very high marks and would like to keep utilizing your services.![]()

John Crowley

Chief Software Architect

Fujifilm NA Corporation, Imaging Division

Customer service is evolving faster than ever — and Agentic AI is leading the charge.

If you’ve heard buzz about AI handling customer interactions, here’s the truth: within the next 12 months, more than half of all customer service conversations will be managed by agentic AI systems. These aren’t your typical chatbots; they’re autonomous, proactive, and deeply contextual digital agents that understand your needs, make decisions on the fly, and act — all to deliver a seamless, personalized experience.

Table of Contents

What Is Agentic AI — And Why Should You Care?

Agentic AI takes AI-powered customer service to the next level. Unlike rule-based bots that simply respond to scripted prompts, agentic AI:

- Understands context — remembers past interactions and adapts conversations.

- Acts proactively — reaches out before problems arise or needs are voiced.

- Makes decisions autonomously — guiding customers and supporting agents alike.

Simply put, it’s customer service that thinks and acts smarter — like having a supercharged, empathetic team member available 24/7.

The AI Shift Is Happening — Fast

According to Cisco’s latest research:

- 56% of all customer interactions will be AI-handled within a year.

- 75% of business leaders believe proactive AI support will reduce customer churn.

- 65% expect to boost customer lifetime value through AI-driven insights.

That’s not just technology hype. It’s a strategic transformation reshaping how companies connect with customers — driving loyalty, satisfaction, and revenue.

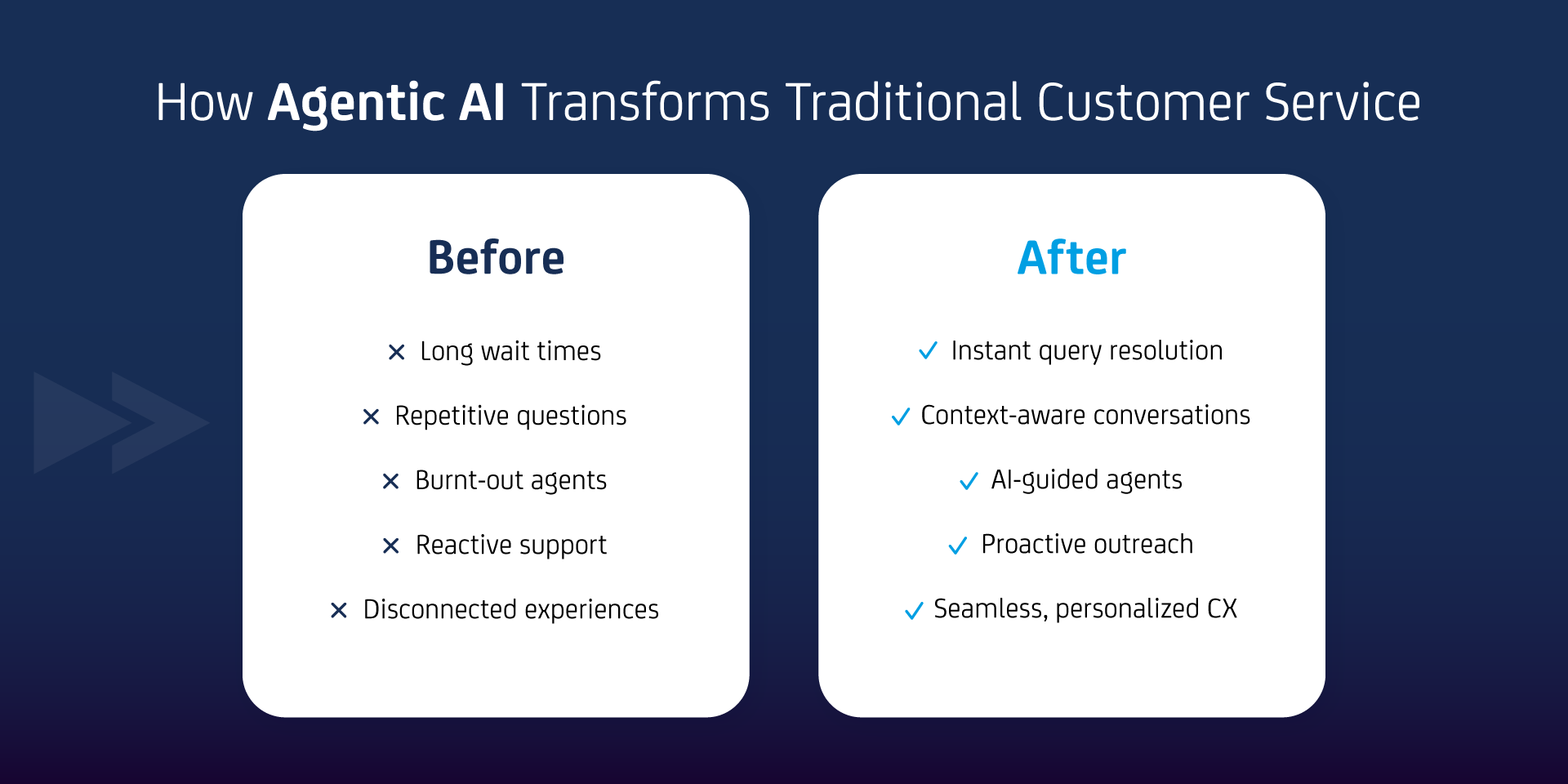

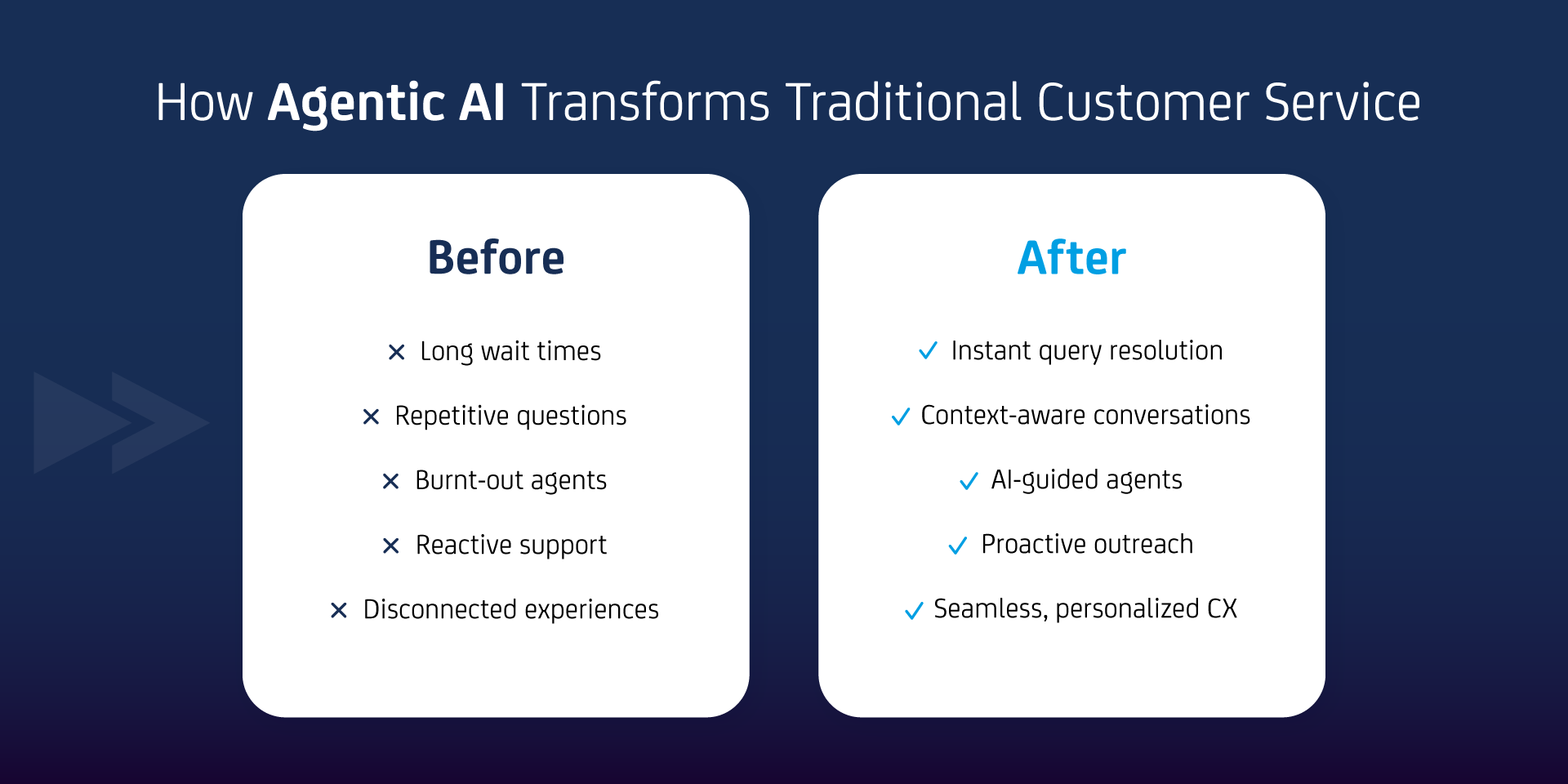

How Agentic AI Changes Customer Service

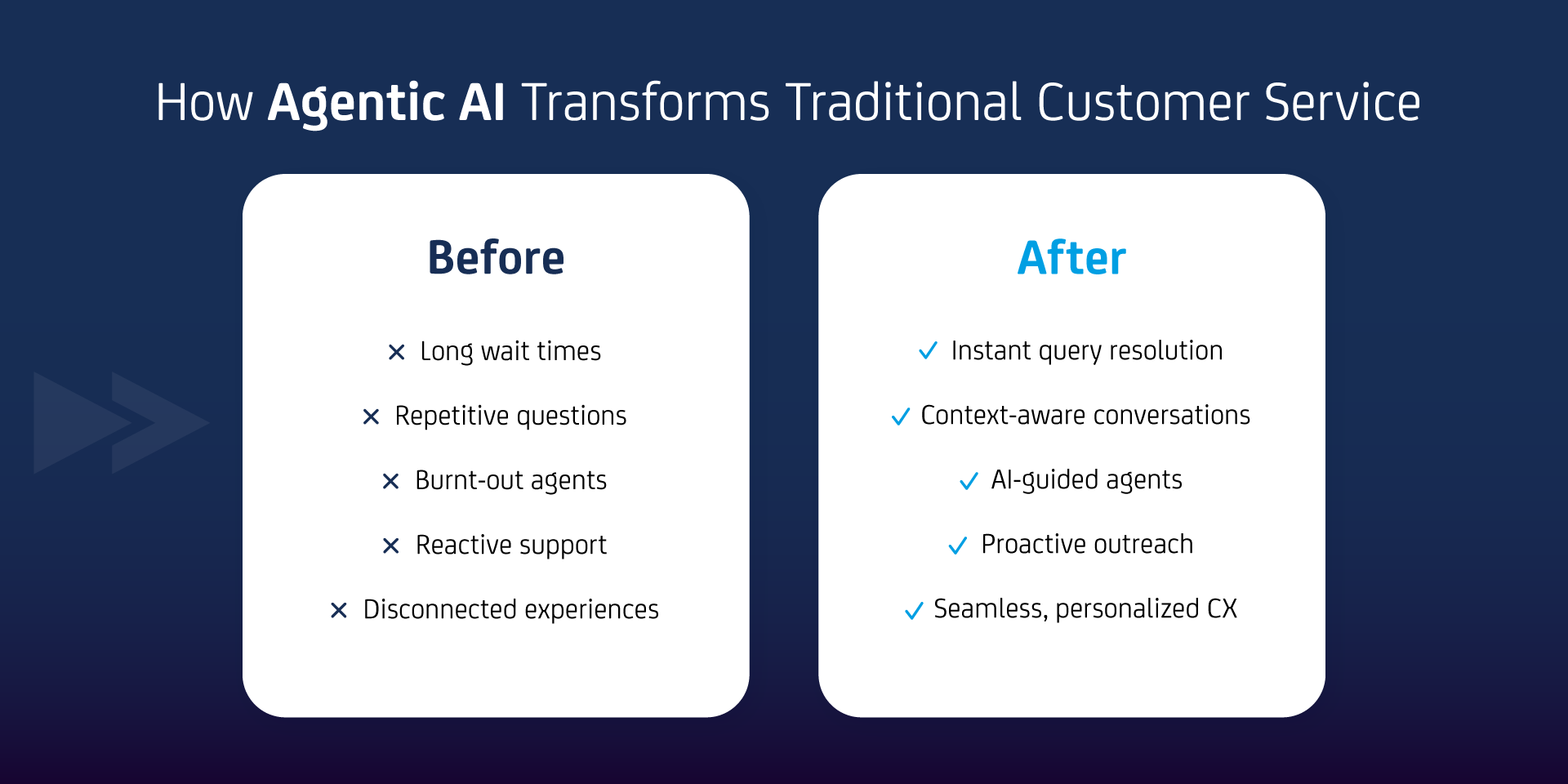

Traditional customer support often struggles with:

- Long wait times

- Repetitive questions

- Burned-out agents

- Reactive responses

- Fragmented experiences

Agentic AI flips this script. This means happier customers and empowered agents — a win-win.

Top Agentic AI Use Cases Transforming Customer Service

Here’s where agentic AI really shines:

- Autonomous Customer Support

Instantly handles routine queries, reducing wait times and deflecting up to 60% of tickets. - Contextual Memory

Keeps track of past conversations so agents respond faster and smarter. - Proactive Outreach

Predicts customer needs — like renewals or potential issues — and acts before you even ask. - Real-Time Assistance

Provides live recommendations on next steps, resources, and tone during customer calls or chats.

Sentiment Detection

Reads emotions to support both customers and agent well-being, tailoring responses with empathy.

Agentic AI Augments Humans — It Doesn’t Replace Them

A common misconception is that AI will replace people. The reality is the opposite. Agentic AI acts as a smart copilot — augmenting human agents to:

- Make better decisions

- Work more efficiently

- Deliver richer, personalized experiences

This collaboration means more productive teams and happier customers.

Conclusion

Agentic AI is revolutionizing the way businesses interact with their customers, making service faster, smarter, and more human-centric. By understanding context, acting proactively, and collaborating with human agents, these intelligent systems turn every customer interaction into an opportunity to build loyalty and drive growth.

Companies that embrace agentic AI now will gain a serious competitive edge — delivering seamless experiences, reducing operational costs, and empowering their teams to focus on what truly matters: creating lasting relationships with customers.

Want to use AI in your business?

Get in touch with the Adanto Software Team today to see how we can help.

![]() “The Adanto team was of the first groups of developers I started working with at Sensaria and really one of the constants during my time here. Thank you for everything over the years – most notably your flexibility and teamwork with the on-shore team, and teaching us key Polish terms along the way. I’m happy to say that the concept of “Little Friday” has spread around Sensaria!”

“The Adanto team was of the first groups of developers I started working with at Sensaria and really one of the constants during my time here. Thank you for everything over the years – most notably your flexibility and teamwork with the on-shore team, and teaching us key Polish terms along the way. I’m happy to say that the concept of “Little Friday” has spread around Sensaria!”![]()

Polly Tobias

Technical Project Manager

Circle Graphics

Finding the right product online can be frustrating. Search results often miss the mark. Filters don’t help much unless you already know what to look for. And recommendation engines mostly rely on what you or others bought in the past.

What if online shopping felt more like talking to someone who actually helps? Not a chatbot with canned replies, but an intelligent system that understands what you need—even if you don’t know how to ask for it.

That’s the promise of AI agents. They’re changing how product discovery works by guiding users like real assistants.

Table of Contents

What Are AI Agents?

AI agents are not just tools that respond to commands. They act more like helpers that can make decisions, ask questions, and carry out tasks.

In e-commerce, AI agents help customers discover the right products. They don’t just throw recommendations based on past clicks. They listen, ask follow-up questions, and adapt their suggestions in real-time.

Example: A shopper says, “I need a laptop for school.” Instead of showing 100+ random laptops, the AI agent asks, “Do you prefer something lightweight? Any specific software you’ll be using?” Based on that, it narrows down the list to options that actually fit the user’s needs.

How Product Discovery Works Today

Most online stores use filters, search bars, and static recommendation engines.

You type in a keyword like “running shoes,” and get hundreds of results. You try filtering by brand, price, or size—but the process is often slow and confusing.

Traditional recommendation systems use browsing or purchase history. If you bought hiking boots last month, you might see more boots—even if you’re now shopping for sandals.

This leads to a poor experience. People scroll, compare, get overwhelmed, and sometimes give up without buying anything.

Why Traditional Tools Miss the Mark

These older systems assume too much. They expect users to know what they want and how to ask for it in the “right” way. But most people shop with vague goals.

Let’s say someone wants a gift for a tech-savvy friend. They may not know whether to search for smartwatches, headphones, or accessories. A keyword search won’t help much.

Filters also fall short when needs are complex.

For example, “eco-friendly office chair for a small home office” doesn’t map well to standard filters like “material” or “brand.”

Recommendation engines rely heavily on data from past users. But past behavior doesn’t always predict future intent—especially for new or infrequent buyers.

What Makes AI Agents Different

AI agents act more like smart assistants than tools. They combine search, filtering, comparison, and conversation in one experience.

They can:

- Understand natural language questions

- Ask follow-ups to clarify vague inputs

- Compare multiple products based on specific needs

- Adjust results in real time

Example: A shopper says, “I need a laptop for school.” Instead of showing 100+ random laptops, the AI agent asks, “Do you prefer something lightweight? Any specific software you’ll be using?” Based on that, it narrows down the list to options that actually fit the user’s needs.

They’re not just filtering—they’re reasoning.

Challenges to Consider

AI agents aren’t perfect. They need accurate and well-structured data to work properly. If your product catalog is outdated or lacks key details (like noise levels or fabric types), the agent can’t make smart choices.

They also need to respect privacy. Over-personalization can feel invasive.

Not everyone wants a “conversation” when shopping. Some users prefer quick browsing. That’s why AI agents should be optional and easy to exit or skip.

What This Means for Online Retailers

AI agents can improve the shopping experience, but they’re not plug-and-play.

To get them right, retailers need to:

- Understand their customer journey

- Structure their product data well

- Choose the right AI platform or partner

- Test with real users

Done right, AI agents can lower bounce rates, increase conversions, and reduce returns. They help people find what they’re actually looking for.

Conclusion

Product discovery shouldn’t feel like work. AI agents make it easier for people to find what fits their needs—even if they don’t know how to say it.

They’re more than search tools. They’re decision helpers.

And they’re already starting to change how people shop online.

Adanto builds custom AI-driven solutions that improve search, discovery, and customer satisfaction.

Schedule a short call to explore what’s possible.

Main page > Case studies > Data Services > Adanto Boosts Service & Cuts Costs with Big Data Analytics

www.myutilities.com

Adanto delivers multi-function CRM platform in record time

Adanto specializes in delivering powerful CRM platforms for business and national sales teams in utilities, combining rapid deployment with robust frameworks, cloud tech, and seamless integrations—without compromising quality.

Main page > Case studies > Data Services > Adanto Boosts Service & Cuts Costs with Big Data Analytics

Robert Half

www.roberthalf.com

Adanto implements BI for Maconomy ERP with SAP BO

Adanto delivers advanced financial planning & reporting tools for a global leader in the professional placement services sector. By deploying SAP BusinessObjects Universes, Adanto streamlined access to critical financial data, enabling custom reporting & dash-boarding.

![]() Adanto has provided superior software engineers we needed to complete our multiple data migration and integration efforts

Adanto has provided superior software engineers we needed to complete our multiple data migration and integration efforts![]()

Krystian Piwowarczyk

Cybersecurity Manager

Vector Synergy

![]() Thank you for putting together with Alvin the architecture, and plan to make it easy for potential customers who are using Shopify for their eCommerce platform to use Fujifilm’s personalization engine by creating a plug-in/extension.

Thank you for putting together with Alvin the architecture, and plan to make it easy for potential customers who are using Shopify for their eCommerce platform to use Fujifilm’s personalization engine by creating a plug-in/extension.![]()

Jim Dolce

Vice President New Business and Software Development

Fujifilm NA Corporation, Imaging Division

![]() Adanto has proven to be an invaluable strategic partner for Cloudify. Having spent many years working with various engineering services company’s Adanto excels not only in the quality and speed of services they deliver but also in their commitment to fairness and transparency

Adanto has proven to be an invaluable strategic partner for Cloudify. Having spent many years working with various engineering services company’s Adanto excels not only in the quality and speed of services they deliver but also in their commitment to fairness and transparency![]()

Luca Rajabi

VP, Solutions

Cloudify

![]() Majic (Maciek) and the rest of Adanto team were great to work with. Thank you.

Majic (Maciek) and the rest of Adanto team were great to work with. Thank you.![]()

Jeff Keihl

Functional Architect, IT Development, Financial Services Applications

Robert Half

![]() You were awarded a contract based on your ability to deliver unmatched technical innovation skills, solid track record of stable and predictable results, offered via progressive people and results-oriented culture.

You were awarded a contract based on your ability to deliver unmatched technical innovation skills, solid track record of stable and predictable results, offered via progressive people and results-oriented culture.![]()

Brett Roscoe

GM

Dell Software

![]() You have truly saved our product from a near demise caused by an incompetence of a far-shore supplier

You have truly saved our product from a near demise caused by an incompetence of a far-shore supplier![]()

Bob Maeser

CTO

Quest Software

![]() We absolutely appreciate all of Adanto’s help in getting Outside Financial off the ground

We absolutely appreciate all of Adanto’s help in getting Outside Financial off the ground![]()

Sonia Stainway

CEO

Outside Financial

![]() We have been continually reassured of Adanto’s versatile portfolio of expertise while tasked with deploying a major multi-national pharmaceutical company’s Secure Transit VPC across multiple geographic regions spanning two continents. Adanto’s ability to work with geographically dispersed teams and deliver on the customer’s terms in multiple timezones is a true differentiator few engineering services company’s can offer.

We have been continually reassured of Adanto’s versatile portfolio of expertise while tasked with deploying a major multi-national pharmaceutical company’s Secure Transit VPC across multiple geographic regions spanning two continents. Adanto’s ability to work with geographically dispersed teams and deliver on the customer’s terms in multiple timezones is a true differentiator few engineering services company’s can offer.![]()

Francesco Alongi

Senior Manager Cloud Strategy

Advanced Informatics and Analytics

Astellas Pharma

![]() Adanto software team with Piotr really rocked.

Adanto software team with Piotr really rocked.![]()

Scott Francis

Sr. Director Applications

Robert Half

![]() Adanto has helped Robert Half and Protivity accelerate our services deliverry and lower our development costs.

Adanto has helped Robert Half and Protivity accelerate our services deliverry and lower our development costs.![]()

James Johnson

VP of IT

Robert Half

![]() I am giving my highest recommendation for Adanto Software. Having dealt previously with a tech who answered in a day or two, Adanto’s responses were truly impressive.

I am giving my highest recommendation for Adanto Software. Having dealt previously with a tech who answered in a day or two, Adanto’s responses were truly impressive.![]()

Paula Miller

CEO

Iconic Idaho

Most e-commerce personalization is still basic. It shows “related items” or “people also bought.” But today’s customers expect more than that. They want help, not suggestions.

Agentic AI makes this possible.

It can understand intent, take action, and guide users through tasks — like a smart assistant inside your store. In this article, we’ll look at how agentic AI is changing the e-commerce experience.

Table of Contents

Why Today’s Personalization Falls Short

Most e-commerce platforms do this:

- You looked at product A → So here’s product B.

- You added one thing → So here’s a “frequently bought together” set.

- You visited twice → Here’s a discount.

It works — until it doesn’t.

These systems rely on patterns, not purpose. They don’t understand what the customer is trying to do.

And when things change — trends, prices, demand, seasons — the system can’t keep up.

What Agentic AI Enables in E-commerce

Imagine you walk into a store. Before you say a word, someone already knows what you’re looking for — not in a creepy way, but because they’ve seen people like you before. They notice what you’re holding, how long you stare at the shelf, and what questions you pause to ask in your head.

Then they say:“Hey, based on what you need — here’s a better way to do this.”

That’s what Agentic AI does. It doesn’t wait for instructions. It watches, learns, and acts — while the shopper is still deciding.

An agent can:

- Understand what the user is trying to do (intent detection)

- Ask questions to fill in missing context

- Decide what steps are needed to help them reach that goal

- Adapt the UI, product options, or offer structure in real time

- Learn from what works or fails — and adjust behavior

Use Case #1: Guided Product Discovery

The problem: Shoppers are overwhelmed. They don’t know what they need — especially with technical or multi-part products.

What happens with an agent:

Someone visits your store looking for gear to film cooking videos. Instead of scrolling through 50 cameras, they answer 3 simple questions. The agent suggests a full setup: camera, tripod, lighting — all matched to their use case. Ready to buy in one click.

Why it matters:

Fewer abandoned sessions. More confident purchases. No guesswork.

Then they say:“Hey, based on what you need — here’s a better way to do this.”

That’s what Agentic AI does. It doesn’t wait for instructions. It watches, learns, and acts — while the shopper is still deciding.

An agent can:

- Understand what the user is trying to do (intent detection)

- Ask questions to fill in missing context

- Decide what steps are needed to help them reach that goal

- Adapt the UI, product options, or offer structure in real time

- Learn from what works or fails — and adjust behavior

Use Case #2: Smart Bundling and Upselling

The problem: Upsells often feel random or pushy. They don’t add real value.

What happens with an agent:

A shopper adds a laptop. The agent builds a remote work bundle — keyboard, monitor, warranty — customized to what makes sense for this model and use. Pricing adapts to stock, season, and margin.

Why it matters:

Higher order value. Smarter promos. Better experience.

Use Case #3: Goal-Based Shopping Journeys

The problem: People often shop with a goal — not a product in mind.

What happens with an agent:

Someone’s planning a 3-day winter hike. The agent builds a checklist: layered clothes, tent, food kits, thermal gear. Checks delivery dates to match their trip. Adds backup options.

Why it matters:

More complete orders. Fewer forgotten items. Real help, not just suggestions.

Use Case #4: Post-Purchase Agents

The problem: After checkout, most brands disappear — or send generic emails.

What happens with an agent:

You buy an espresso machine. The agent follows up with setup help, cleaning tips, offers for beans or accessories, and a reminder to leave a review — timed to when you’ve actually used it.

Why it matters:

Longer retention. More upsells. Better product experience.

Conclusion

Agentic AI won’t replace your team. But it can do what static systems can’t: act in real time, for real people, based on real context.

It turns your store into something smarter. Something that helps users get what they came for — without the friction.

If you care about lifetime value, conversion, and customer experience, this is worth exploring.

Want to use AI in your business?

Get in touch with the Adanto Software Team today to see how we can help.

Main page > Case studies > Data Services > Adanto Boosts Service & Cuts Costs with Big Data Analytics

Robert Half

www.roberthalf.com

Adanto Delivers AWS-Powered Job Alert Marketing Automation

Adanto delivers a multilingual marketing automation workflow using AWS, Salesforce, Eloqua, and Drupal for the global web marketing team of a leading Silicon Valley consulting enterprise.

![]() “The Adanto team was of the first groups of developers I started working with at Sensaria and really one of the constants during my time here. Thank you for everything over the years – most notably your flexibility and teamwork with the on-shore team, and teaching us key Polish terms along the way. I’m happy to say that the concept of “Little Friday” has spread around Sensaria!”

“The Adanto team was of the first groups of developers I started working with at Sensaria and really one of the constants during my time here. Thank you for everything over the years – most notably your flexibility and teamwork with the on-shore team, and teaching us key Polish terms along the way. I’m happy to say that the concept of “Little Friday” has spread around Sensaria!”![]()

Polly Tobias

Technical Project Manager

Circle Graphics

Main page > Case studies > Data Services > Adanto Boosts Service & Cuts Costs with Big Data Analytics

Honeywell Int’l Inc.

Adanto Delivers IoT-Enabled HA Telemetry for Gas Pipelines

Adanto delivered an IoT-enabled HA telemetry solution for gas pipelines, ensuring 99.9% uptime, real-time monitoring, and auto-healing. Operational for over eight years, it provides reliable, scalable, and environmentally friendly gas transportation.

Key Results

$2.7M

Annual savings through reduced maintenance, downtime, & optimized energy usage

$1.5M

Annual costs savings from incidents prevention & ensured compliance

$2.1M

Annual revenue growth from more client value of increased throughput & better utilization

Technologies used

- Infrastructure:

- IBM Power 6 servers running IBM AIX operating system

- Power VM for load separation

- Power HA for Telemetry System HA

- Oracle RAC for database HA

- Moxa Industrial Ethernet switches

- CISCO Catalyst switches and routers

- Brocade SAN switches

- IBM Disk Storage & Tape Storage: 2 tape drives and 48 LTO-3 tapes.

- Tivoli Storage Manager

- Performance:

- 99.9% system availability & 500ms data sampling density

- Full redundancy of hardware and software components

- 6 months data retention for raw data

- 3-year data retention for data reporting

- RTO < 8h & RPO < 48h

- Bare metal recovery

- >3TB of telemetry data

- >1000 data samples read per second

- Max 40ms recovery time after network topology change

Challenge

Our oil and gas pipeline client faced challenges operating in remote, inaccessible terrain, requiring real-time monitoring of gas flow. Manual oversight was impractical, and the client needed a highly available, IoT-enabled solution to process large volumes of telemetry data, ensure reliability, minimize maintenance, and maintain safety and regulatory compliance.

Key goals

Real-Time Monitoring: Ensure continuous, real-time tracking of natural gas flow metrics for safety and efficiency

High Availability: Deliver a 99.9% uptime system with auto-healing and redundancy to prevent disruptions

Scalability: Handle high-density telemetry data with scalable infrastructure and long-term data retention

Low Maintenance: Provide a self-sustaining solution with automated updates for remote, inaccessible locations

Solution

Adanto delivered an IoT-enabled high-availability telemetry solution for real-time monitoring and management of natural gas pipelines in remote and challenging terrains. This solution provided safe, reliable, and efficient operations with minimal manual intervention, meeting the client’s goals for scalability, reliability, and environmental compliance. The solution included:

- High-Availability Clusters: Designed for 99.9% uptime, ensuring continuous monitoring and operational reliability

- IoT-Enabled Sensors and Systems: Integrated real-time data collection and processing of over 1,000 telemetry data samples per second.

- Robust Infrastructure: Leveraged IBM Power servers, Oracle RAC databases, industrial-grade networking equipment, and cloud storage for scalability and performance.

- Automation and Resilience: Implemented auto-healing features for system updates, firmware upgrades, and software patches with minimal maintenance.

- Secure Data Retention: Ensured long-term storage of telemetry data (6 months for raw data, 3 years for reporting) and rapid recovery capabilities.

Let's connect

More Success Stories

In 2024, global fraud losses reached $485 billion, with digital payment fraud rising by 18% year-over-year. The fraud landscape is evolving fast—driven by automation, AI-assisted scams, and synthetic identities. Traditional fraud detection systems struggle to keep pace, largely because they rely on rule-based logic and reactive human workflows.

To respond in real time, organizations need systems that can act on their own. This is where autonomous AI agents come into play. These agents don’t just identify fraud—they execute decisions, trigger actions, and evolve with each case they process. In short, they operationalize intelligence at machine speed.

In this article, I’ll explain how these agents work, what they’re capable of, and where they’re already delivering measurable impact — particularly in financial services, insurance, and e-commerce.

Table of Contents

What Is an Autonomous AI Agent?

Autonomous AI agents are software entities that can perceive data, reason over it, make decisions, and take actions—without human intervention. These agents typically combine:

- Real-time data ingestion

- Machine learning (often anomaly detection, clustering, or reinforcement learning)

- A decision-making engine

- A trigger mechanism (e.g., blocking, alerting, escalating)

Unlike static ML models embedded in a rules-based system, autonomous agents are built for continuous operation. They interact with other systems, manage workflows, and adapt based on outcome feedback.

Why Traditional Fraud Detection Falls Short?

Most fraud detection pipelines today are reactive:

- Transactions are scored based on predefined thresholds

- Alerts are queued for review

- Analysts triage cases manually

- Action is taken hours or days later

This approach introduces delays, fatigue, and inconsistency. Worse, fraudsters exploit these weaknesses with rapid attacks that mimic normal behavior. Static systems can’t detect these dynamic patterns fast enough—and they certainly can’t respond in real time.

How Autonomous Agents Address the Gap?

Autonomous agents are designed to close the decision-action loop. Here’s how:

- Continuous monitoring: They evaluate live data streams rather than periodic batches.

- Pattern learning: They learn over time—detecting not just known fraud, but emerging anomalies.

- Decision execution: They act immediately—freezing accounts, flagging claims, or launching investigation workflows.

- Feedback loops: They learn from past actions, enabling them to refine future decisions.

Agents can also operate across systems—integrating with CRMs, payment processors, document repositories, and third-party data providers.

Key use cases and results

Let’s explore where autonomous agents are already in use, and what kind of value they’re delivering.

Financial Services – End-to-End Case Handling

A credit union partnered with Accelirate to streamline its fraud operations. An AI agent was deployed to:

- Check transactions across Symitar and Extranet

- Match against historical behavior

- Eliminate duplicates

- Trigger escalation workflows

Results:

- 657 analyst hours saved annually

- 98% reduction in processing errors

- $19,800 in direct cost savings

Insurance – Claims Fraud Detection

An insurer used an agent to review low-dollar claims submitted within short timeframes across multiple user profiles. The agent:

- Flagged matching metadata and document reuse

- Pulled historical claims from different user IDs

- Auto-generated fraud reports for the investigation team

Results:

- 245% ROI within the first year

- $320,000+ in savings

- 62% reduction in claim resolution time

E-Commerce – Loyalty Abuse Prevention

Retailers are increasingly targeted by bot-driven attacks—fake signups, coupon abuse, and identity farming. AI agents can:

- Detect fake account clusters (shared IPs, browser fingerprints, timing anomalies)

- Flag attempts to exploit loyalty programs

- Pause reward disbursement and notify risk teams

Impact: Fewer false positives than rules-based systems, with real-time enforcement and reduced operational load on fraud teams.

Fintech Lending – Synthetic Identity Detection

Fintech lenders deal with high volumes and thin data. One client used agents to catch applications that:

- Used slightly altered identity data (e.g., different DOB or SSNs with matching addresses)

- Applied to multiple loan products in rapid sequence

- Reused documents across supposedly unrelated accounts

The agent connected the dots and auto-rejected risky applicants before credit was issued.

Known Challenges And Risks

No system is perfect. There are trade-offs to consider:

- Explainability: Deep-learning agents can make decisions that are hard to justify without traceable logic. This is a concern for regulated industries.

- Bias: If agents are trained on biased data, they may reinforce discrimination (e.g., falsely flagging users based on geography or demographic patterns).

- Overreach: Agents acting too aggressively (e.g., false account freezes) can damage user trust and create compliance risks.

To mitigate these, agents should be built with human-in-the-loop oversight, audit trails, and risk thresholds that define when automation is allowed to act independently.

What To Expect Going Forward

Autonomous AI agents will evolve beyond single-use cases. We’re seeing early adoption of multi-agent systems, where:

- One agent focuses on transaction-level fraud

- Another monitors identity risk over time

- A third handles response orchestration and user communication

This layered approach builds resilience and adaptability.

We’re also likely to see closer integration with identity verification, KYC, behavioral biometrics, and external fraud intelligence feeds.

Conclusion

Autonomous agents are not silver bullets. But they are a necessary shift. As fraud tactics grow more automated, detection and prevention must move at the same pace.

The true value of these agents isn’t just speed—it’s consistency, scalability, and reduced human burden. In areas like fintech, e-commerce, and insurance, the business case is already clear.

Want to use AI in your business?

Get in touch with the Adanto Software Team today to see how we can help.

Talking to a business should feel easy. But long wait times, repeated questions, and poor support can frustrate customers. That’s where Voice AI agents come in. These tools are designed to handle real-time conversations using artificial intelligence. They can understand what people say, figure out what they need, and respond with a voice that sounds natural. Unlike basic phone menus or chatbots, Voice AI agents can hold two-way conversations and offer real help—without involving a human agent every time.

In this article, we’ll walk through what a Voice AI agent is, how it works, what features matter, and how it can help your business. If you’re exploring ways to improve customer service or reduce call center costs, this guide will give you a solid starting point.

Table of Contents

What is a Voice AI Agent?

A Voice AI Agent is a virtual assistant that communicates with users via spoken language. Unlike traditional IVR (Interactive Voice Response) systems that follow rigid scripts and often frustrate users, Voice AI Agents use artificial intelligence to understand, interpret, and respond in a natural, human-like way.

They can handle a wide range of tasks:

- Answering customer support queries

- Booking appointments

- Providing product recommendations

- Processing orders

- Collecting feedback

Think of them as digital team members who never sleep, don’t lose patience, and continuously improve over time.

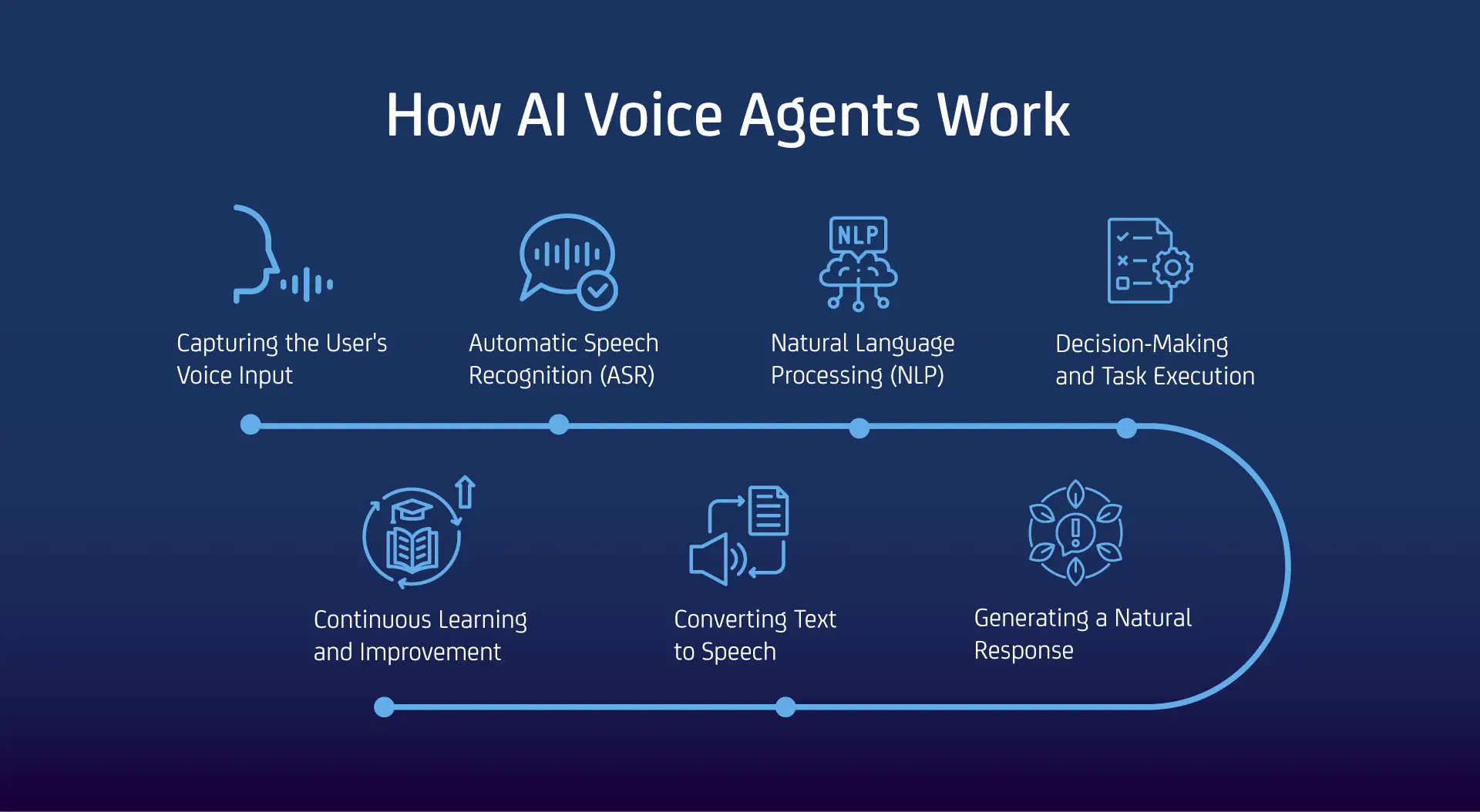

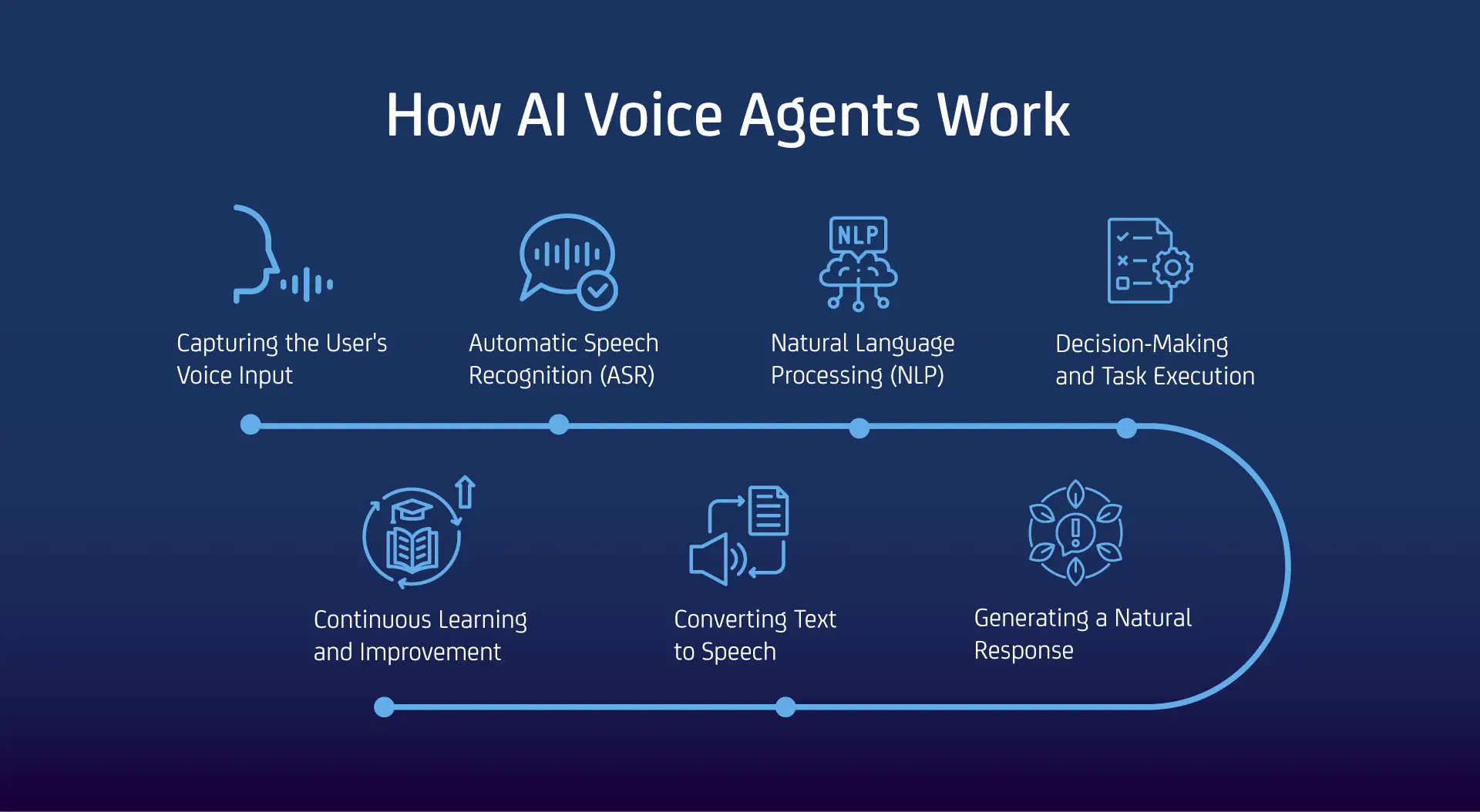

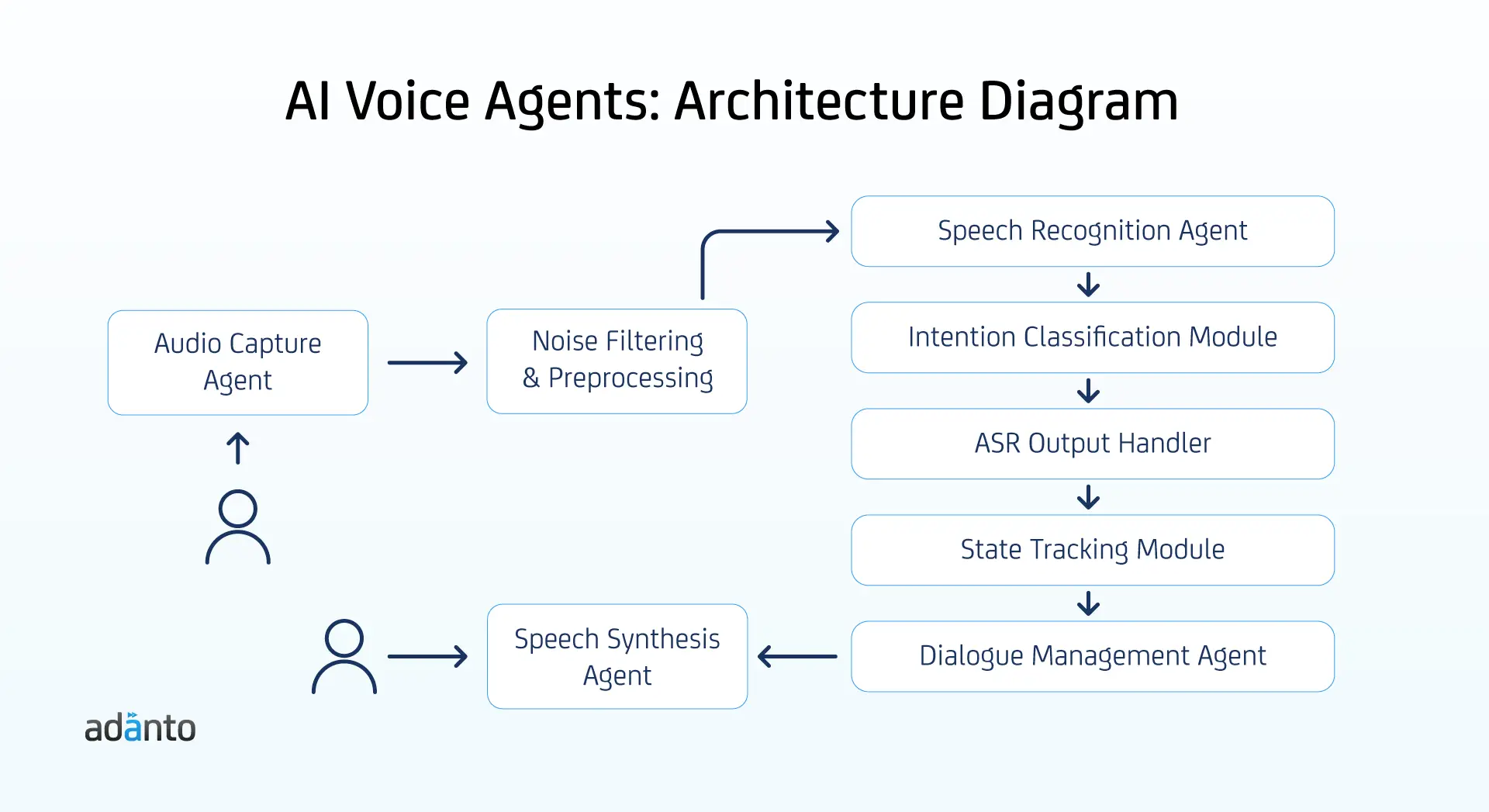

How AI Voice Agents Work

A Voice AI Agent works through a blend of voice recognition, natural language processing, machine learning, and backend integration. When a user speaks, the AI listens, deciphers intent, and crafts a meaningful response—all in real time.

Here’s a typical flow:

- User Speaks: “I want to know my order status.”

- Voice Input is Captured via microphone or phone call.

- Speech-to-Text (STT): Converts spoken words into written text.

- Natural Language Understanding (NLU): Interprets what the user means.

- Dialog Manager: Decides how to respond.

- Text-to-Speech (TTS): Converts the reply back into speech.

- Voice Output: “Sure, let me check your order. Can I have your order number?”

It all happens in seconds—and gets smarter with every conversation.

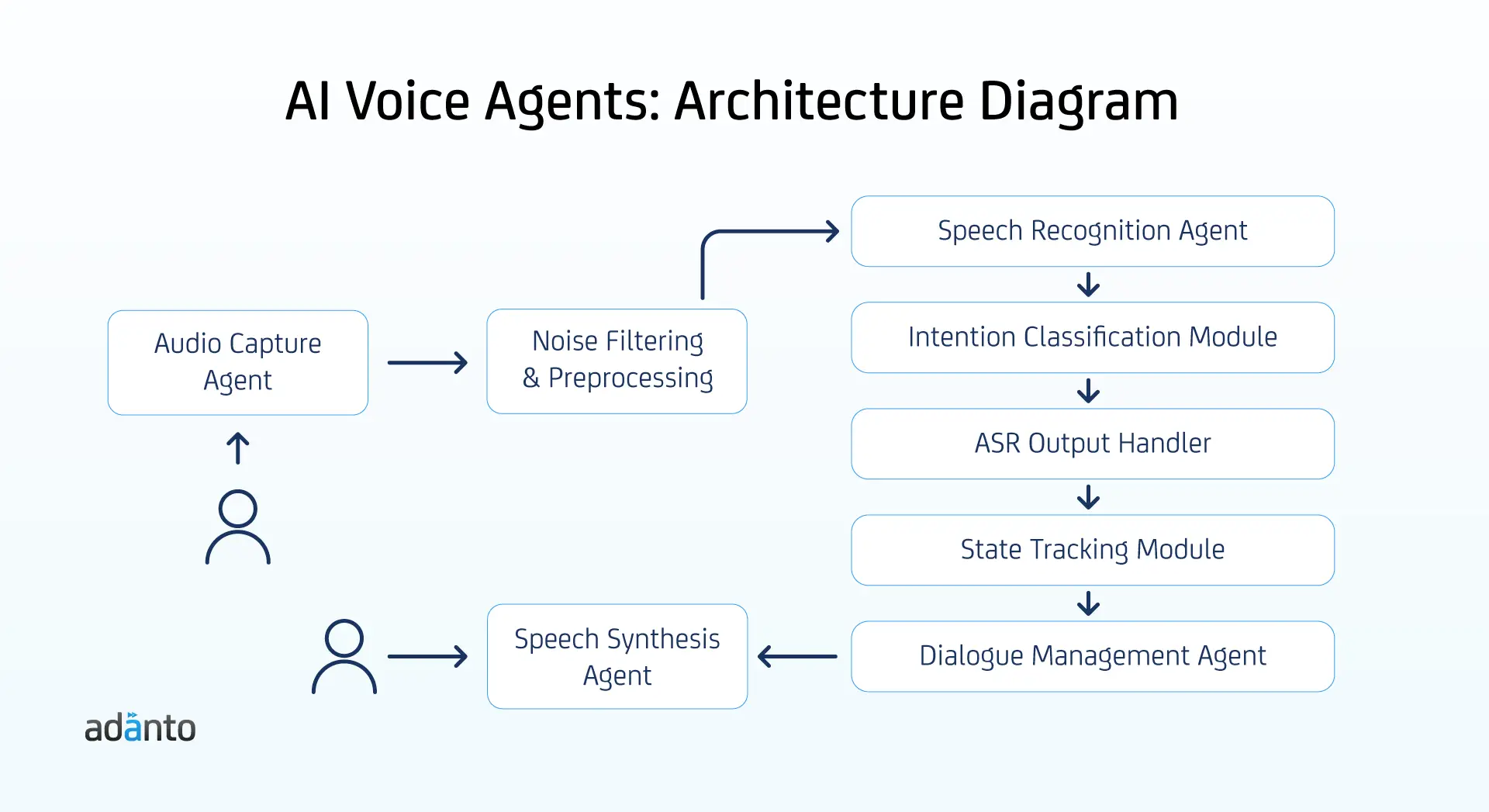

Key Components of Voice AI Agent Architecture

To understand how these agents operate, let’s break down their core architecture:

- Automatic Speech Recognition (ASR)

This component transforms spoken language into text. Accuracy here is crucial—especially with different accents, speeds, or background noise. - Natural Language Processing (NLP)

NLP handles two parts: understanding user intent and generating a human-like response. It’s what allows the agent to grasp the meaning behind words. - Dialog Management System (DMS)

The DMS decides how the agent responds. It uses context, previous interactions, and logic flows to ensure the conversation feels natural. - Text-to-Speech (TTS)

Converts the AI’s response from text back to speech. Modern systems now have expressive, natural-sounding voices with varied tones and emotions. - Backend/API Integrations

To be truly useful, Voice AI Agents must connect with CRMs, order systems, databases, calendars, and other business tools.

Training & Analytics Layer

This layer helps the system learn from user interactions, spot friction points, and improve accuracy over time.

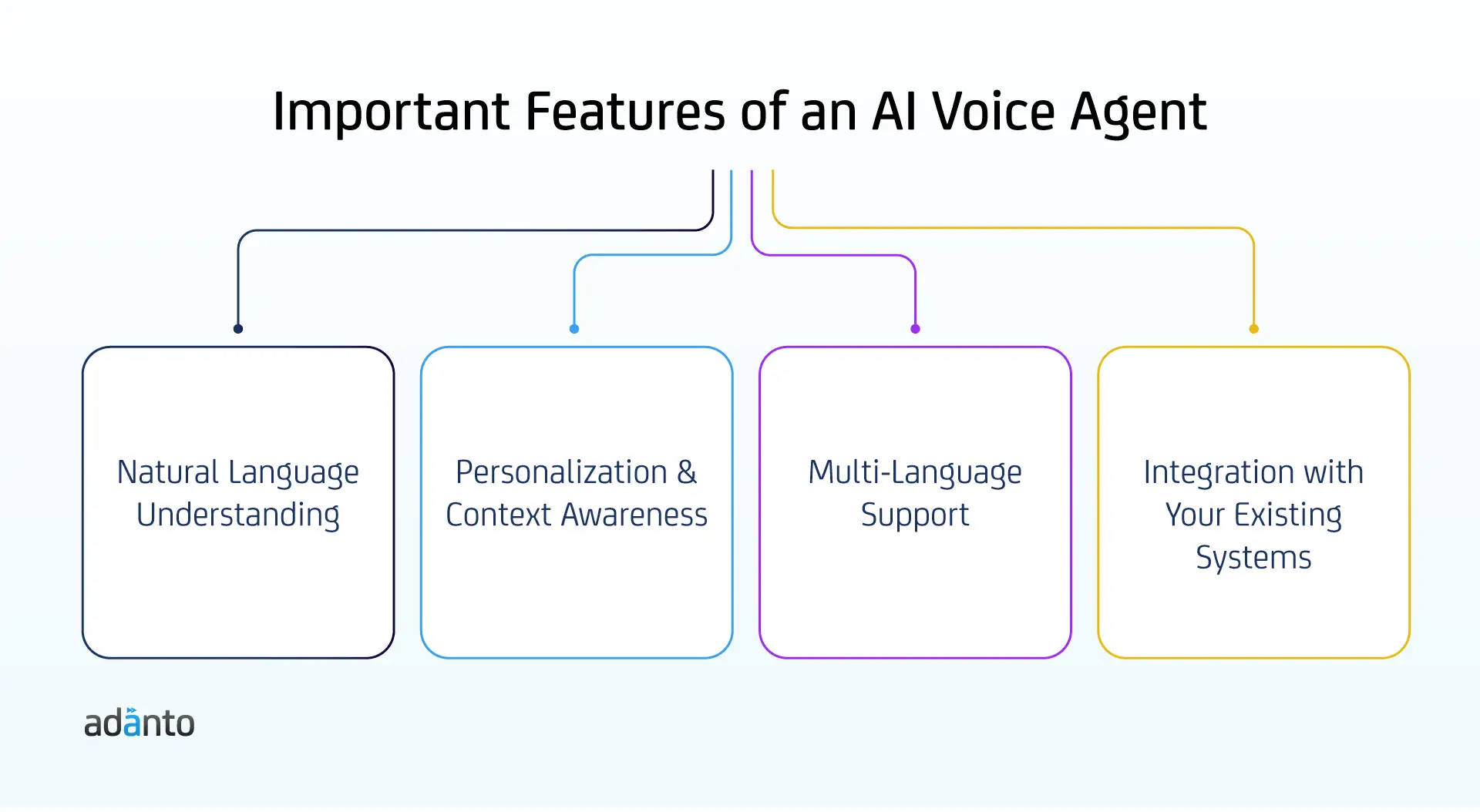

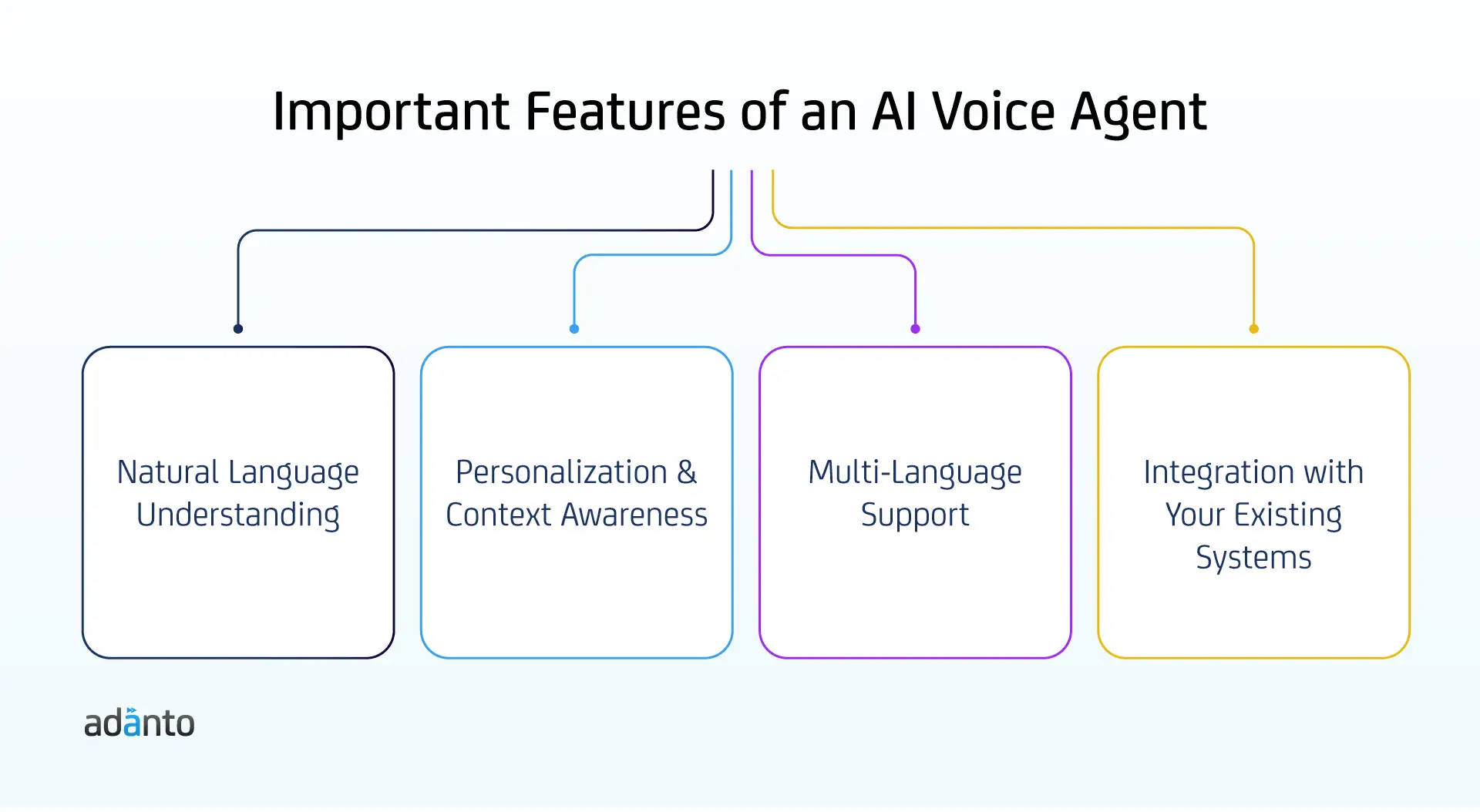

Important Features of an AI Voice Agent

What makes a voice AI agent powerful and business-ready? Here are key features to look for:

- Real-Time, Natural Conversations: No awkward pauses or robotic replies. It should talk like a real person.

- Context Retention: Good agents remember previous interactions within a session—sometimes even across sessions.

- Multilingual Support: Serve customers in their native language or dialect.

- Personalization: Greet users by name, remember preferences, and adapt responses.

- 24/7 Availability: AI agents never clock out.

- Scalability: Handle thousands of conversations simultaneously without delays.

Seamless Handover: When needed, they can transfer the conversation to a human agent—complete with conversation history.

Benefits of Voice AI Agents for Your Business

Why should a business invest in a voice AI agent?

Imagine you’re running an e-commerce company. During peak shopping season, your support team is swamped with queries: “Where’s my order?”, “Can I return this item?”, “What’s your exchange policy?”

Instead of hiring and training dozens of temporary agents, a voice AI agent can:

- Handle 80% of repetitive queries automatically

- Reduce customer wait time to near zero

- Free up your human team for complex cases

- Cut operational costs significantly

- Increase customer satisfaction with quick, consistent answers

And in industries like banking, healthcare, and retail, AI voice agents are already showing measurable ROI—from improved conversion rates to reduced churn.

Conclusion

Voice AI Agents are a smart way for businesses to talk to customers quickly and easily. They can answer questions, help with orders, and give support—any time, day or night.

They don’t replace your team, but they help your team work better by handling simple, repetitive tasks. This means faster service for customers and lower costs for your business.

Let’s Talk

At Adanto Software, we help companies build and use Voice AI Agents that fit their needs. If you’re thinking about using AI to improve your customer experience, we’re here to help you get started.

![]() Adanto SOC consultation and proposal was very compelling and on par with the GE proposal. Your security engineers are very caapable.

Adanto SOC consultation and proposal was very compelling and on par with the GE proposal. Your security engineers are very caapable.![]()

Mark Hopkins

Security Operations (SOC) Lead

Robert Half

![]() In my continuing work at F/22 Consulting I engage numerous companies that all face the ever-present and escalating challenge of developing and managing software projects in order to remain competitive. Not only did Adanto graciously and professionally rise to every challenge (even the unreasonable!) but they always completed the projects on time and exceeded expectations unfailingly. I am happy to have this resource available to recommend on what I’m sure will be a frequent basis.

In my continuing work at F/22 Consulting I engage numerous companies that all face the ever-present and escalating challenge of developing and managing software projects in order to remain competitive. Not only did Adanto graciously and professionally rise to every challenge (even the unreasonable!) but they always completed the projects on time and exceeded expectations unfailingly. I am happy to have this resource available to recommend on what I’m sure will be a frequent basis. ![]()

Frank Baillargeon

CEO

Iconic Idaho

![]() Adanto and especially Magic were instrumental in getting our iTrack Reporting Workstream Project on track and successful, beyond expectations. Thank you. The whole team was wonderfule to work with in on site in San Ramon, CA and off-site from Poland

Adanto and especially Magic were instrumental in getting our iTrack Reporting Workstream Project on track and successful, beyond expectations. Thank you. The whole team was wonderfule to work with in on site in San Ramon, CA and off-site from Poland![]()

Thuy Nguyen

Sr. Manager, IT Development

Robert Half

![]() Adanto has added great value to Brett, our CTO, and his team to get us off the ground in eCommerce

Adanto has added great value to Brett, our CTO, and his team to get us off the ground in eCommerce![]()

Andrew Cousin

CEO

Circle Graphics/Sensaria

Finding the right product online can be frustrating. Search results often miss the mark. Filters don’t help much unless you already know what to look for. And recommendation engines mostly rely on what you or others bought in the past.

What if online shopping felt more like talking to someone who actually helps? Not a chatbot with canned replies, but an intelligent system that understands what you need—even if you don’t know how to ask for it.

That’s the promise of AI agents. They’re changing how product discovery works by guiding users like real assistants.

Table of Contents

What Are AI Agents?

AI agents are not just tools that respond to commands. They act more like helpers that can make decisions, ask questions, and carry out tasks.

In e-commerce, AI agents help customers discover the right products. They don’t just throw recommendations based on past clicks. They listen, ask follow-up questions, and adapt their suggestions in real-time.

Example: A shopper says, “I need a laptop for school.” Instead of showing 100+ random laptops, the AI agent asks, “Do you prefer something lightweight? Any specific software you’ll be using?” Based on that, it narrows down the list to options that actually fit the user’s needs.

How Product Discovery Works Today

Most online stores use filters, search bars, and static recommendation engines.

You type in a keyword like “running shoes,” and get hundreds of results. You try filtering by brand, price, or size—but the process is often slow and confusing.

Traditional recommendation systems use browsing or purchase history. If you bought hiking boots last month, you might see more boots—even if you’re now shopping for sandals.

This leads to a poor experience. People scroll, compare, get overwhelmed, and sometimes give up without buying anything.

Why Traditional Tools Miss the Mark

These older systems assume too much. They expect users to know what they want and how to ask for it in the “right” way. But most people shop with vague goals.

Let’s say someone wants a gift for a tech-savvy friend. They may not know whether to search for smartwatches, headphones, or accessories. A keyword search won’t help much.

Filters also fall short when needs are complex.

For example, “eco-friendly office chair for a small home office” doesn’t map well to standard filters like “material” or “brand.”

Recommendation engines rely heavily on data from past users. But past behavior doesn’t always predict future intent—especially for new or infrequent buyers.

What Makes AI Agents Different

AI agents act more like smart assistants than tools. They combine search, filtering, comparison, and conversation in one experience.

They can:

- Understand natural language questions

- Ask follow-ups to clarify vague inputs

- Compare multiple products based on specific needs

- Adjust results in real time

Example: A shopper says, “I need a laptop for school.” Instead of showing 100+ random laptops, the AI agent asks, “Do you prefer something lightweight? Any specific software you’ll be using?” Based on that, it narrows down the list to options that actually fit the user’s needs.

They’re not just filtering—they’re reasoning.

Challenges to Consider

AI agents aren’t perfect. They need accurate and well-structured data to work properly. If your product catalog is outdated or lacks key details (like noise levels or fabric types), the agent can’t make smart choices.

They also need to respect privacy. Over-personalization can feel invasive.

Not everyone wants a “conversation” when shopping. Some users prefer quick browsing. That’s why AI agents should be optional and easy to exit or skip.

What This Means for Online Retailers

AI agents can improve the shopping experience, but they’re not plug-and-play.

To get them right, retailers need to:

- Understand their customer journey

- Structure their product data well

- Choose the right AI platform or partner

- Test with real users

Done right, AI agents can lower bounce rates, increase conversions, and reduce returns. They help people find what they’re actually looking for.

Conclusion

Product discovery shouldn’t feel like work. AI agents make it easier for people to find what fits their needs—even if they don’t know how to say it.

They’re more than search tools. They’re decision helpers.

And they’re already starting to change how people shop online.

Adanto builds custom AI-driven solutions that improve search, discovery, and customer satisfaction.

Schedule a short call to explore what’s possible.

![]() I am very excited about how Adanto has helped Circle Graphics to utilize the eCommerce and Magento expertise and very efficient deployment model.

I am very excited about how Adanto has helped Circle Graphics to utilize the eCommerce and Magento expertise and very efficient deployment model.![]()

Bret McInnis

CTO

Circle Graphics/Sensaria

![]() Adanto has helped us be more productive and monitor costs of an AWS cloud

Adanto has helped us be more productive and monitor costs of an AWS cloud![]()

James Wetzig

Sr. Manager, Architecture & Infrastructure Platform Delivery

Robert Half

![]() Your engineers have been doing great and are very proactive

Your engineers have been doing great and are very proactive![]()

Jerry Jarvis

Sr. Director of IT

Protiviti

![]() Great knowledge and quick response in architecting the mobile app with its entire delivery data platform

Great knowledge and quick response in architecting the mobile app with its entire delivery data platform![]()

Harg Malhi

VP, Engineering

American Express

Customer support is changing. For years, businesses relied on scripts and predefined workflows to handle conversations. It worked—up to a point.

Most support interactions still start the same way.

A customer runs into a problem. They reach out for help. And what do they get?

A chatbot that repeats their question. A phone system that loops them around. A support agent stuck reading from a script.

The customer gets frustrated. The agent feels stuck. Nobody wins.

This isn’t how support should work in 2025. And thanks to Agentic AI, it doesn’t have to.

Table of Contents

Why Scripted Support Falls Short

Think about the last time you contacted support. You probably had one clear goal—get something fixed.

But instead, you got a list of steps that didn’t match your issue. Or had to repeat yourself three times. Or got passed between three people who all asked for the same details.

That’s what scripted systems do. They assume every problem is simple. They treat every customer the same.

But real problems are messy. Customers don’t follow scripts. So why should support?

What Agentic AI Does Better

Agentic AI doesn’t follow a script. It follows a goal.

Instead of matching inputs to preset replies, it looks at the bigger picture. It can ask questions, gather missing info, make decisions, and even take action—like updating an account or sending a follow-up email.

It can handle back-and-forth without losing context. It remembers what the customer said earlier. And it can change its approach if the situation shifts.

This makes the conversation feel more natural. And it gets things done faster.

Real-World Use Cases

Here’s how companies are already using Agentic AI in support:

- In e-commerce, Agentic AI is handling returns, tracking packages, and even flagging repeat fraud attempts.

- In fintech, it’s guiding users through document verification, clarifying account rules, or escalating flagged transactions.

- In travel, it’s helping passengers rebook flights, offer options, and reissue tickets—all while dealing with weather delays.

- In retail, it’s solving problems before they reach a live agent, or freeing up agents to focus on escalations.

These aren’t just FAQs. They’re real tasks that usually need human input. Agentic AI can now handle many of them—end to end.

What This Means for Support Teams

Agentic AI isn’t here to replace support teams. It’s here to take care of the boring stuff.

Agents don’t need to answer the same password-reset question 100 times a day. They don’t need to copy-paste policy links. Or route simple issues to other teams.

Instead, they can focus on what matters—complex cases, sensitive topics, or customers who really need a human touch.

Support roles will shift. But they won’t disappear. Teams will need new skills, like prompt design, oversight, and exception handling.

Conclusion

Scripted support had its time. But it’s no longer enough.

Customers want faster, smarter, more flexible help. Agentic AI can deliver that. It works with goals, not rigid flows. It handles complexity better. And it gets closer to how people actually talk.

We’re moving toward a support system that’s more intelligent, more efficient, and less frustrating.

Adanto Software helps businesses design and build intelligent support systems using real Agentic AI.

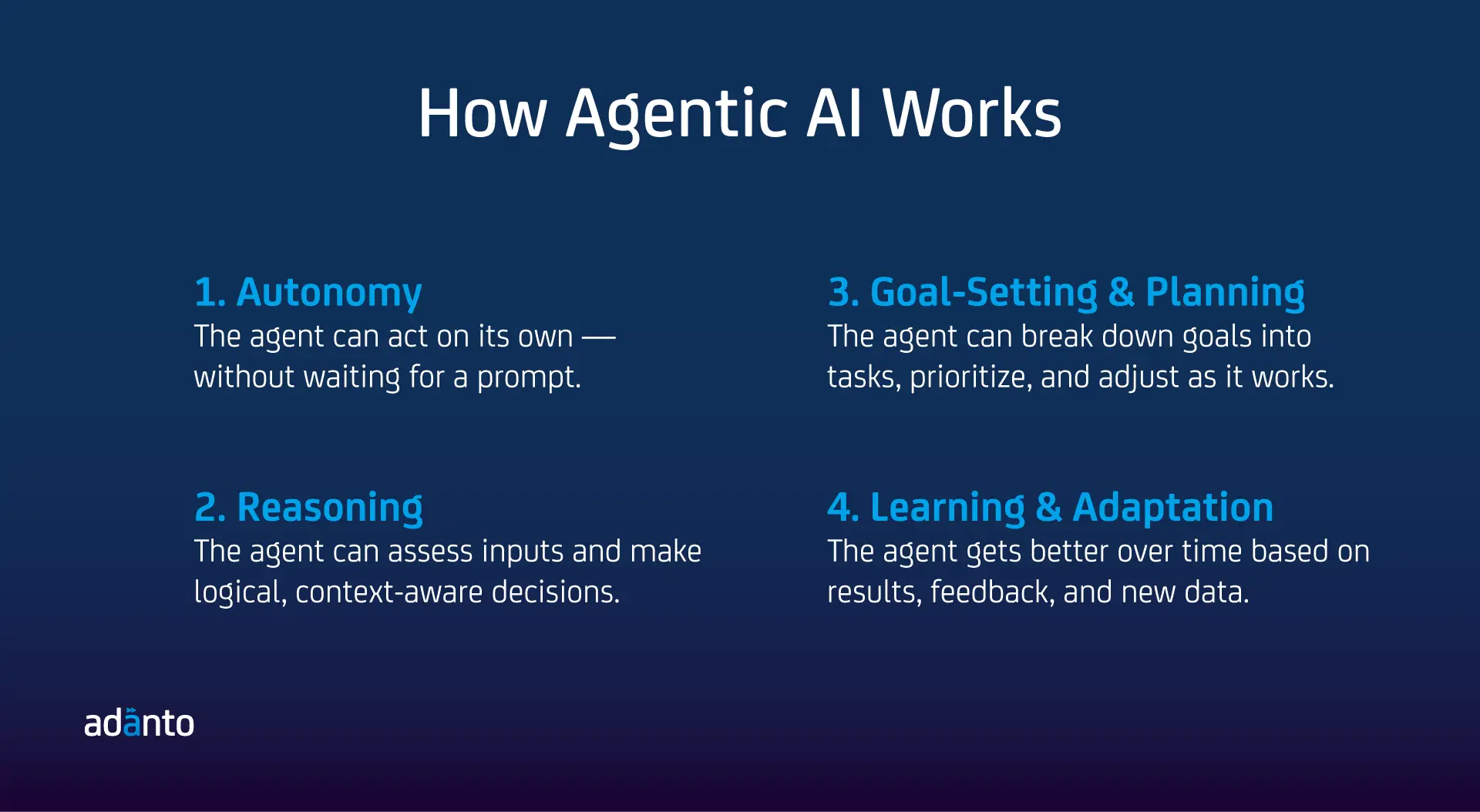

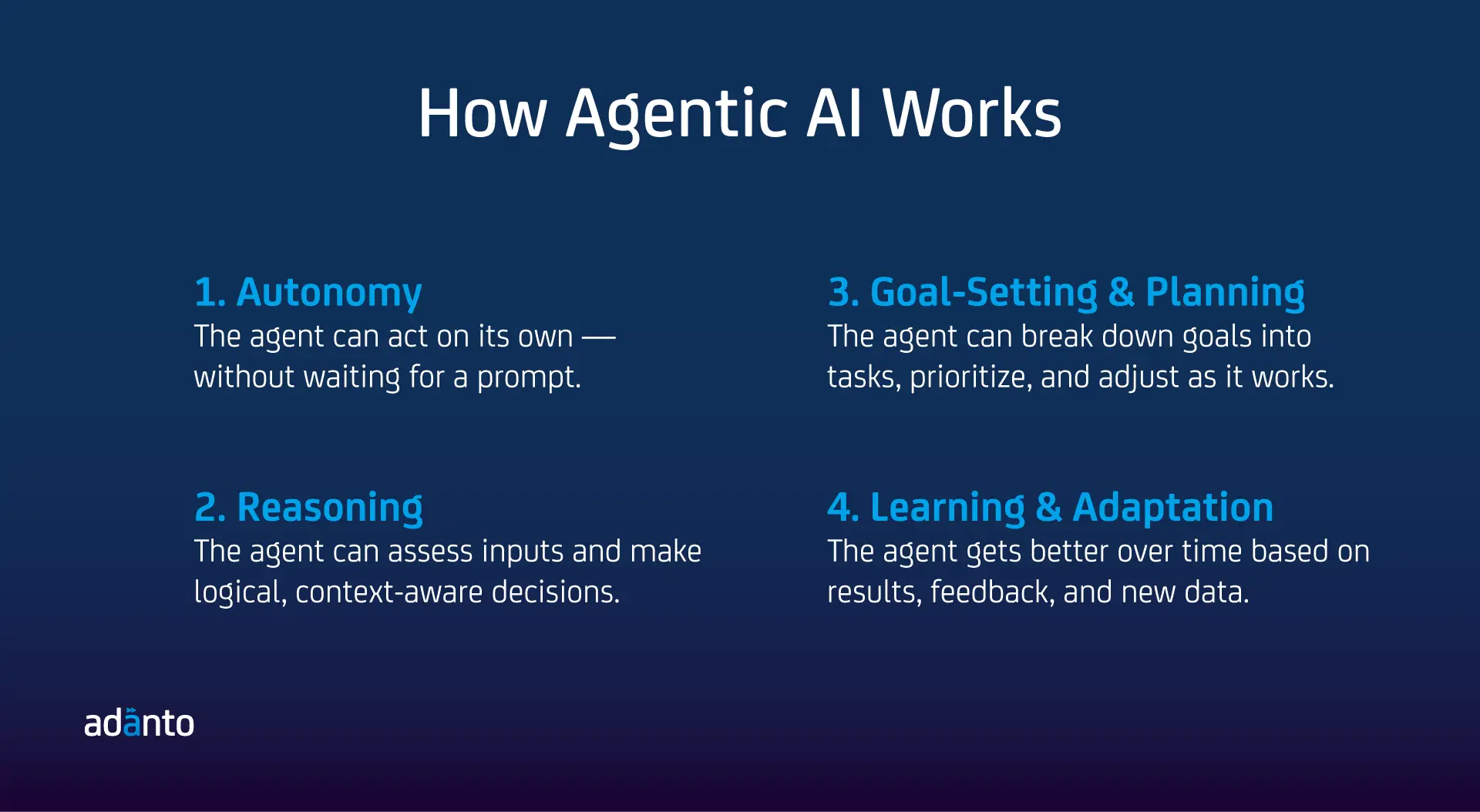

Artificial intelligence has come a long way – from basic automation to powerful language models. But the real revolution is happening now with Agentic AI: a new class of intelligent systems that can autonomously reason, plan, and act in pursuit of goals.

In this blog, we’ll break down what Agentic AI is, why it matters, and what makes it the most powerful AI architecture yet.

Table of Contents

What Is Agentic AI?

Agentic AI refers to intelligent software agents capable of setting goals, making decisions, and acting autonomously in dynamic environments—without the need for step-by-step human instruction.

These AI agents can:

- Interpret high-level objectives

- Break them down into tasks

- Decide on a course of action

- Execute and adapt in real time

In simple terms: Agentic AI thinks, acts, and learns independently—delivering proactive value rather than passively responding to commands.

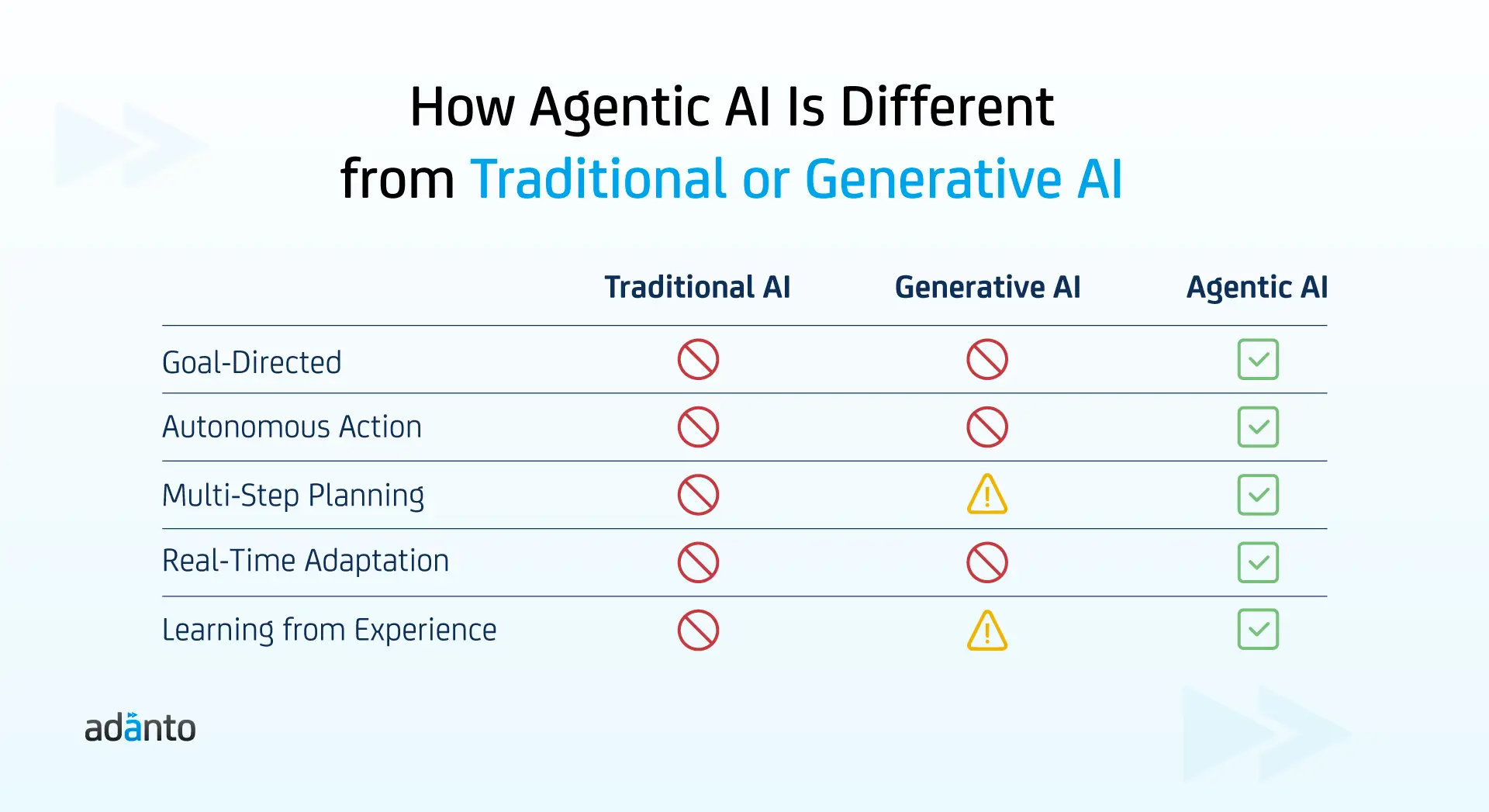

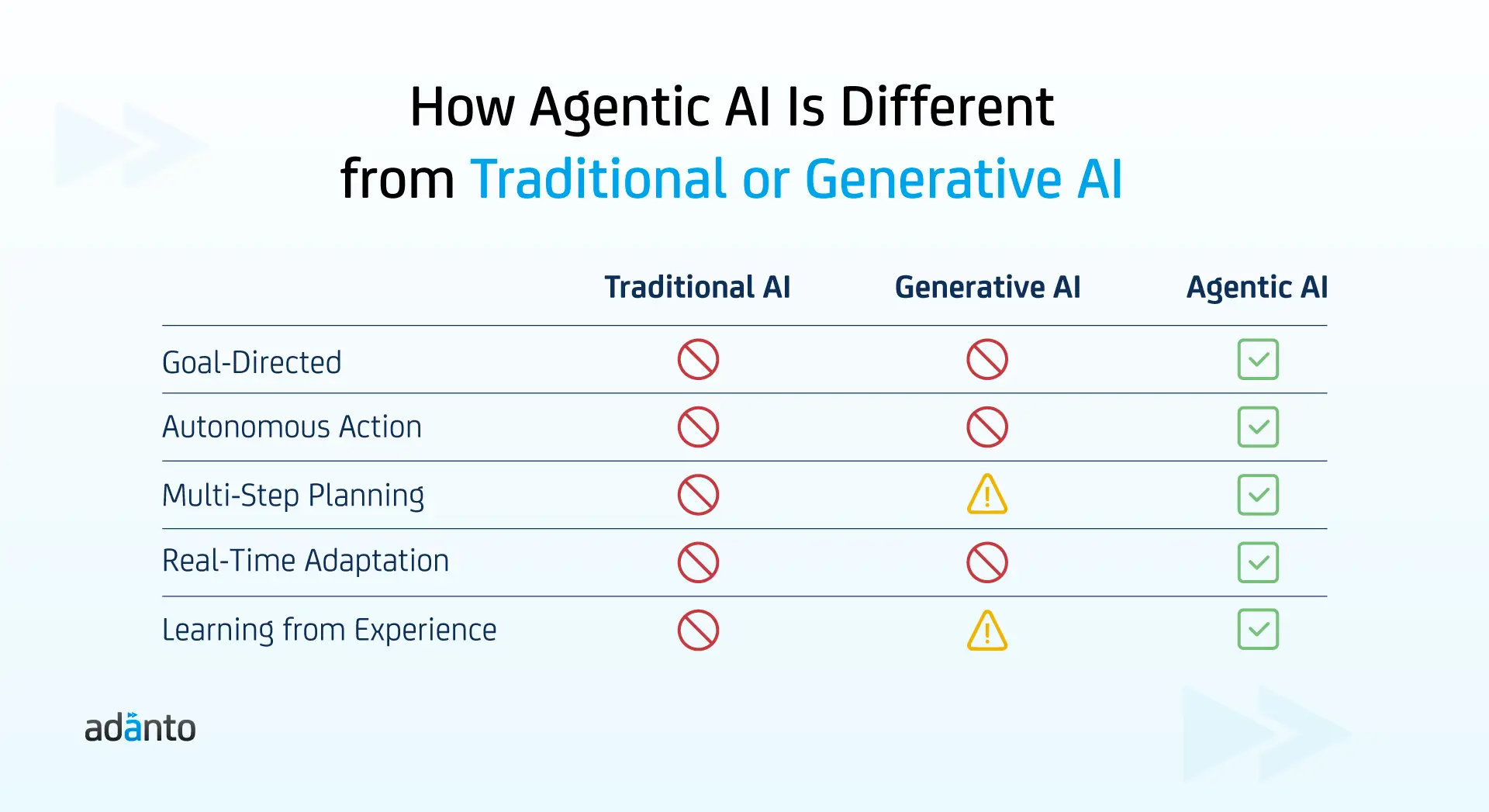

Why Agentic AI Is a Paradigm Shift

Artificial Intelligence has evolved in waves:

- Traditional AI was built on rigid rules, statistical models, and pattern recognition—great for automation, but limited to narrow, pre-defined tasks.

- Generative AI brought creativity and contextual understanding, producing human-like text, images, and code from natural language prompts—but it still depends on static inputs and doesn’t take initiative.

Now, Agentic AI is redefining the entire model. It blends the best of previous AI generations—pattern recognition, generative capability, and contextual reasoning—with a new layer of autonomy and intentionality. These AI agents don’t just respond to prompts or follow workflows. They set goals, make decisions, and adapt their strategies dynamically—much like a human employee or collaborator would.

This shift is architectural.

Shift in Capabilities

1. From Reactive to Proactive

Traditional AI and chatbots wait for user input before acting. Agentic AI, by contrast, can anticipate needs, detect opportunities or risks, and take action—sometimes before a human even notices the problem.

🧠 Example: An AI sales agent notices a drop in pipeline velocity and automatically re-engages cold leads or recommends campaign changes—without waiting for a prompt.

2. From Static Rules to Dynamic Learning

Earlier AI systems were rule-based—requiring constant tuning, training, and human oversight. Agentic AI evolves through feedback loops, reinforcement learning, and real-time environmental cues, continuously improving its own performance.

🔁 Example: A customer support agent learns that certain ticket types lead to high churn. It starts escalating those tickets faster and suggesting new macros to human reps.

3. From Task Automation to Strategic Autonomy

Automation solves isolated tasks. Agentic AI tackles complex, multi-step goals that require reasoning, prioritization, and cross-functional coordination.

🎯 Example: In e-commerce, instead of just recommending a product, an agent can run a sequence of actions: detect cart abandonment, tailor follow-up offers, test different discount levels, and adapt based on conversion success—all autonomously.

Core Capabilities of Agentic AI

1. 🛰 Autonomy

Autonomy is the defining trait of Agentic AI. These agents can initiate actions, orchestrate processes, and make decisions independently—without waiting for step-by-step instructions or constant human intervention.

Rather than being reactive, autonomous agents observe the environment, recognize triggers, and take meaningful actions—all on their own.

Example in Fintech:

An agent monitoring financial transactions identifies a suspicious pattern indicative of potential fraud. Instead of just flagging it, the agent pauses the transaction, initiates a real-time compliance review, and notifies relevant teams—all autonomously.

2. 🧠 Reasoning

Reasoning gives agents the ability to analyze data, weigh alternatives, and make logic-driven decisions – even in ambiguous or dynamic environments.

Agents aren’t just rule-followers—they’re decision-makers. They can process unstructured inputs, understand context, and take the most appropriate next step based on situational logic and learned patterns.

Example in E-commerce:

An AI agent reviews a shopper’s recent behavior: abandoned cart, high browsing time, and frequent returns. It decides whether to offer a discount, recommend an alternative product, or trigger a loyalty email—based not on a script, but on intelligent evaluation of buyer intent.

3. 🎯 Goal-Setting and Planning

Agentic AI doesn’t just execute tasks—it can set goals, break them down into subtasks, choose how to proceed, and dynamically re-plan based on progress.

Agents understand objectives, create strategies to achieve them, and adapt those strategies over time. This makes them capable of managing multi-step processes and aligning with broader business outcomes.

Example in Customer Service:

An AI agent receives an overarching goal: “Reduce response time for high-priority tickets.” It analyzes ticket flow, identifies bottlenecks, reorganizes queues, and prioritizes escalations—while adjusting tactics as volume shifts or issues evolve.

4. 🔄 Learning and Adaptation

Through continuous exposure to new data and feedback, Agentic AI can learn from experience, refine its models, and improve performance over time.

These agents develop memory and evolve behavior. They analyze outcomes, learn what works (and what doesn’t), and apply those learnings the next time—without requiring reprogramming.

Example in Retail Planning:

An inventory optimization agent tracks real-time sales, seasonal fluctuations, and local trends. Over time, it learns that certain items sell better during specific events or weather patterns—and adjusts stocking and pricing strategies accordingly.

Conclusion

Agentic AI isn’t just the next step in automation — it’s a shift in how work gets done.

These systems don’t wait for instructions. They make decisions, take action, and improve with every cycle. That means less micromanagement, faster execution, and smarter results.

If your business runs on speed, scale, or complexity — that’s the future of staying competitive.

Want to use AI in your business?

If you’re curious how Agentic AI could work in your business — whether that’s improving support, spotting risks early, or making operations more efficient — we’d be glad to walk you through it.

![]() The quality and skills of your engineers are very impressive. You have helped us accelerate the delivery of our fin tech prototype that has turned heads at Zions Bank

The quality and skills of your engineers are very impressive. You have helped us accelerate the delivery of our fin tech prototype that has turned heads at Zions Bank![]()

Joel Schwartz

CEO

DoubleCheck Solutions

![]() Glad that Adanto could get us started with IAM Automation Tool and Security metrics for our CISO and my Information Security Services Organization.

Glad that Adanto could get us started with IAM Automation Tool and Security metrics for our CISO and my Information Security Services Organization.![]()

Jason Zirkelbach

Sr. Director - Enterprise Information Security

Robert Half

![]() Thank you for your help in migration to the Dell infrastructure.

Thank you for your help in migration to the Dell infrastructure.![]()

Richard Leurig

SVP, GM Innovation & Technology

Core Logic

![]() Adanto speed in responding to concerns is great. You are really great to work with.” CG ProPrints Team

Adanto speed in responding to concerns is great. You are really great to work with.” CG ProPrints Team![]()

AJ McDonald

Director, Brand Marketing, Art Division

Circle Graphics/Sensaria

![]() Adanto has performed the project on time and to our complete satisfaction. We have achieved our goal of improved visibility in our global call centers and could fix issues much quicker for our internal clients

Adanto has performed the project on time and to our complete satisfaction. We have achieved our goal of improved visibility in our global call centers and could fix issues much quicker for our internal clients![]()

Eddie Borrero

Chief Information Security Officer

Robert Half

Main page > Case studies > Data Services > Adanto Boosts Service & Cuts Costs with Big Data Analytics

Robert Half

www.roberthalf.com

Adanto Powers Big Data Democratization for Robert Half

Adanto delivers a cloud-based Big Data Lake solution for a Silicon Valley consulting leader, eliminating data silos, reducing costs, and enabling seamless access to raw data. The solution fosters a data-driven culture and empowers users with scalable, flexible analytics.

![]() Chetan Ghai, our Chief Product Officer, and I know how fast Adanto has created an application for Robert Half that intergates our patented Quill technology and so we are very convinced how strong your team is.

Chetan Ghai, our Chief Product Officer, and I know how fast Adanto has created an application for Robert Half that intergates our patented Quill technology and so we are very convinced how strong your team is. ![]()

Mauro Mujica-Parodi III

VP, Product

Narrative Science

![]() Thank you for the design plan of Fujifilm eCommerce Plug-ins integration of our Simple Ordering Platform (SOP) with Shopify and MediaClip that adds a product builder functionality in the Shopping Cart, then submit it via SPA API.

Thank you for the design plan of Fujifilm eCommerce Plug-ins integration of our Simple Ordering Platform (SOP) with Shopify and MediaClip that adds a product builder functionality in the Shopping Cart, then submit it via SPA API.![]()

Alvin Scott

Senior Software Product Manager

Fujifilm NA Corporation, Imaging Division

Customer service is evolving at lightning speed. As customers demand faster, smarter, and more personalized support, traditional call centers and help desks struggle to keep up. Enter Agentic AI — autonomous, proactive, and context-aware systems that don’t just respond to requests but think, decide, and take action on your behalf.

If you’re wondering how to bring Agentic AI into your customer service, here are three game-changing ideas — each tackling a real challenge and driving measurable results.

Table of Contents

Autonomous Handling of Routine Support Tickets

The Challenge:

Your support team is swamped with repetitive, low-complexity queries — order tracking, password resets, return policies. These take time, frustrate customers with wait times, and drain resources that could be better spent on complex issues.

How Agentic AI Helps:

Agentic AI can autonomously manage these routine requests without human intervention. It understands the context, provides instant, accurate answers, and escalates only when needed — all while remembering customer history to keep conversations smooth.

The Outcome:

- Slash ticket volume by up to 60%

- Cut average response times drastically

- Free up your agents to focus on what truly matters

- Boost customer satisfaction with faster, smarter support

Proactive Customer Engagement to Reduce Churn

The Challenge:

Many companies wait too long to engage customers about renewals, upgrades, or potential issues. The result? Missed opportunities, avoidable churn, and lost revenue.

How Agentic AI Helps:

Agentic AI monitors customer behavior and subscription timelines, predicting when customers need outreach. It sends personalized messages or offers before a customer even realizes they might leave or have a problem.

The Outcome:

- Cut churn rates by 20–30% or more

- Increase upsell and cross-sell conversions

- Build stronger, proactive relationships with your customers

- Lighten the load on your human agents

Real-Time AI Assistance to Empower Agents

The Challenge:

Customer service agents often face complex or emotionally charged interactions without real-time guidance. This can lead to slower resolutions, inconsistent experiences, and agent burnout.

How Agentic AI Helps:

Imagine an AI sitting beside your agent during calls or chats — suggesting the best responses, surfacing relevant knowledge, and even detecting customer emotions to adapt the approach on the fly.

The Outcome:

- Speed up call resolution times by 15% or more

- Improve customer sentiment and satisfaction

- Reduce agent stress and turnover

- Ensure consistent, on-brand communication every time

Ready to Bring Agentic AI Into Your Customer Service?

The future of customer service is proactive, personalized, and powered by intelligent AI that augments your team — not replaces it. Whether you start with automating routine tickets, proactive outreach, or real-time agent support, Agentic AI can transform your customer experience while boosting efficiency.

Reach out to the experts at Adanto Software.

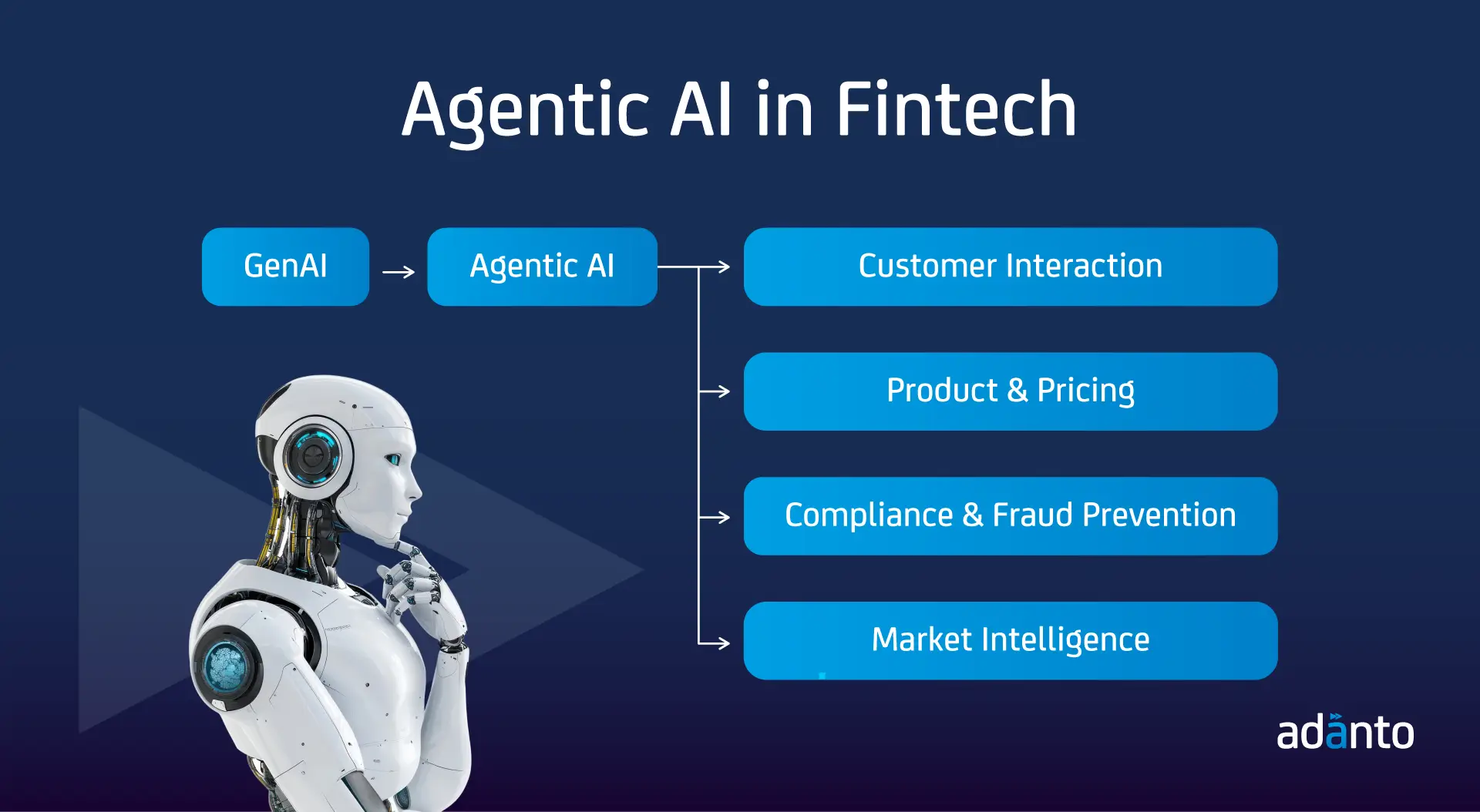

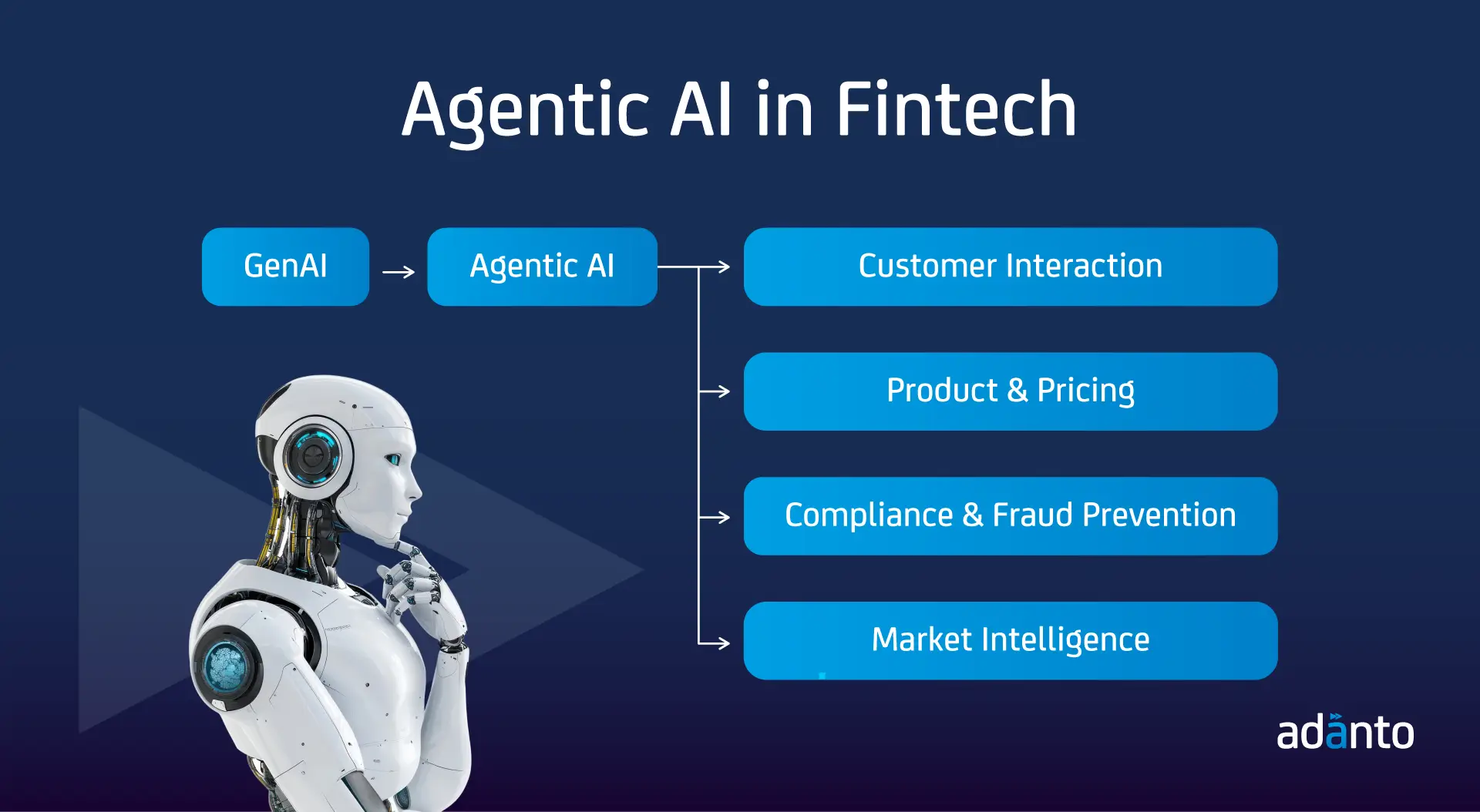

Imagine a mid-sized bank overwhelmed with millions of transactions, thousands of loan applications, and tens of thousands of customer queries every day — all demanding lightning-fast decisions and razor-sharp accuracy. The stakes couldn’t be higher: a single missed fraud alert or a delayed credit decision could cost millions or destroy client trust overnight.

This is the reality fintech faces, and it’s why Agentic AI has emerged as a game-changer. Today, financial institutions wield AI not only to automate routine tasks but to drive complex decisions, personalize client experiences at scale, and navigate turbulent markets in real time.

Table of Contents

Why Agentic AI Matters in Financial Services — By the Numbers

According to recent studies, AI adoption in financial services has grown by over 70% in the last three years, with the global AI in fintech market projected to reach $26 billion by 2027, growing at a CAGR of 23%. Firms investing in advanced AI systems report a 30-40% improvement in operational efficiency and significantly faster turnaround times on credit decisions, compliance checks, and customer service.

These statistics represent measurable impact across the financial ecosystem, from retail banking to asset management:

- 70% of financial firms have integrated AI into at least one business function, primarily fraud detection and customer service (Source: Deloitte).

- AI-driven credit assessments reduce loan default rates by up to 25% through better risk profiling (Source: McKinsey).

- Automated transaction monitoring powered by AI can detect suspicious activity with 95% accuracy, cutting false positives by 50% (Source: Accenture).

- Firms using AI for customer engagement report up to 20% increase in client retention thanks to personalized financial coaching and real-time advice (Source: PwC).

The financial industry saves an estimated $447 billion annually through AI-enabled automation in compliance and operational tasks (Source: Business Insider Intelligence).

Use Cases of Agentic AI in Financial Services

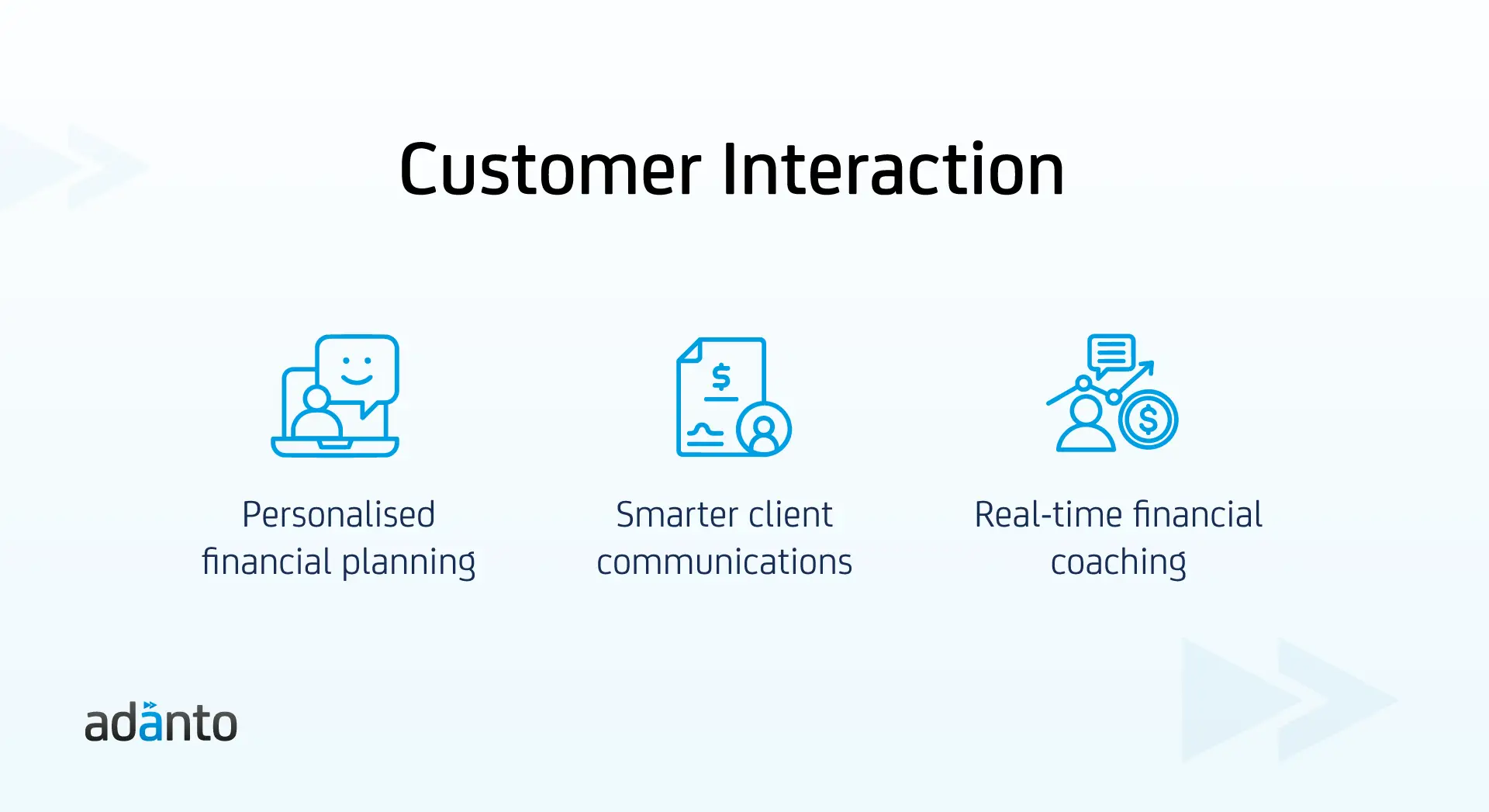

Enhancing Customer Interaction

In a sector where customer trust and engagement are paramount, Agentic AI transforms how firms interact with their clients.

- Client Engagement: Agentic AI automates personalized financial planning tools, creating tailored app interfaces that adjust dynamically to individual client profiles and needs.

- Relationship Management: By optimizing communication channels and tailoring engagement strategies, financial institutions can maintain stronger client relationships and increase satisfaction.

- Personal Financial Advisory: Real-time coaching and financial advice based on clients’ spending patterns enable more proactive and relevant financial guidance.

This not only improves client experiences but also drives loyalty and retention.

Innovating Product and Pricing Strategies

Agentic AI enables smarter product offerings and dynamic pricing models, giving firms an edge in competitive markets.

- Credit Assessment & Loan Origination: AI evaluates creditworthiness with higher precision, customizes loan offers, and autonomously manages portfolios with high-risk profiles, reducing defaults and improving underwriting efficiency.

- Dynamic Pricing: Pricing models adjust in real time according to client behavior, market conditions, and risk factors, optimizing retention offers and revenue.

Such adaptability results in more competitive, customer-centric products.

Strengthening Compliance and Fraud Prevention

Regulatory compliance and fraud detection are among the most complex and critical challenges for financial firms. Agentic AI excels in these areas by continuously monitoring and reacting to emerging threats.

- Transaction Monitoring: Detects anti-money laundering (AML) risks by flagging suspicious transactions and dynamically intervening before damage occurs.

- Claims and Underwriting: Automates triaging processes and refines risk models to improve accuracy and speed.

- Financial Risk Surveillance: Tracks market threats in real time and recommends mitigation strategies.

- Software Compliance Testing: Identifies bugs, ensures regulatory compliance, and deploys seamless updates.

- Process Automation and Quality: Triages complaints efficiently and detects operational anomalies to maintain service excellence.

By automating these critical processes, Agentic AI helps reduce operational costs and mitigate legal and reputational risks.

Driving Market Intelligence and Competitive Advantage

Agentic AI empowers financial institutions with deeper market insights and strategic agility.

- Competitive Market Analysis: Continuously tracks competitor strategies and uncovers actionable insights for tactical decision-making.

- Market Trend Surveillance: Monitors shifts in the financial landscape, alerting analysts to emerging risks or opportunities early.

This intelligence supports proactive strategy development and faster response to market changes.

Conclusion: Why Financial Firms Can’t Afford to Ignore Agentic AI

Financial services face increasing pressure from tighter regulations, rising customer expectations, and intense competition. Agentic AI is proving to be a vital tool that drives faster decisions, improves risk management, and personalizes customer experiences at scale.

The data is clear: firms using Agentic AI gain real advantages in efficiency and retention. Those that hesitate risk falling behind more agile competitors.

Want to use AI in your business?

Get in touch with the Adanto Software Team today to see how we can help.

![]() The Adanto team was one of the first groups of developers I started working with at Sensaria and really one of the constants during my time here. Thank you for everything over the years – most notably your flexibility and teamwork with the on-shore team, and teaching us some key Polish terms along the way. I’m happy to say that the concept of “Little Friday” has spread around Sensaria!

The Adanto team was one of the first groups of developers I started working with at Sensaria and really one of the constants during my time here. Thank you for everything over the years – most notably your flexibility and teamwork with the on-shore team, and teaching us some key Polish terms along the way. I’m happy to say that the concept of “Little Friday” has spread around Sensaria!![]()

Polly Eron (Tobias)

Technical Project Manager

Circle Graphics/Sensaria

![]() Adanto Team has exceeded my expectations, delivered solid results and offered very valued support in place of several previous suppliers who have only left confusion and lots of bugs

Adanto Team has exceeded my expectations, delivered solid results and offered very valued support in place of several previous suppliers who have only left confusion and lots of bugs![]()

Jeanne McDonald

CFO

Tangible Investments

![]() Adanto has done a nearly impossible task of replacing the previous bankig-as-a-service provider with a new one SYNAPSE in just five weeks; for a platform they had never seen before. Adanto pulled it off

Adanto has done a nearly impossible task of replacing the previous bankig-as-a-service provider with a new one SYNAPSE in just five weeks; for a platform they had never seen before. Adanto pulled it off![]()

Mark Vanderbeek

CTO

Rego Payment Architectures, Inc.

Key Results

$2.6M

Annual Cost Savings from IT infrastructure optimization and automation & efficiency

$1M+

Annual productivity gains from time & effort savings and faster decision-making

$500k+

Business Enablement gains from improved SLA compliance & new insights, innovation & agility

Services performed

- Data Science

- Data Analytics & Business Intelligence

- Data Warehousing

- Big Data

- Machine Learning

- Artificial Intelligence

- DevOps

- Security

- Infrastructure Services

- Salesforce

- Amazon Cloud

- Azure Cloud

Technologies used

Data Sources/Silos

- 60+ data sources

- 200+ GB of new data per day

- One Data Store (Data in different AWS data stores based on data type)

- Amazon S3

- Amazon EC2

- Amazon Redshift (data warehouse for standard SQL queries & BI tools)

- Amazon RDS (relational database for many instance types)

- Apache Sqoop (O/S tool for bulk data transfers)

- Amazon HDFS (Parquet) (Hadoop Cluster with EMR – Elastic MapReduce)

Query Tools & Analytics

- Apache Hive, Pig, Spark (O/S database query interface tools to HDFS & processing engine)

- R (O/S statistical programming language for data mining and statistical computing)

- Mahout/scikit-learn (O/S tools for building Machine Learning apps)

- QlikView, PowerBI, SAS (data analytics, business intelligence and reporting tools)

Challenge

Robert Half was challenged with lack of easy access to company’s enterprise data. The company faced multiple challenges for which it was seeking a solution:

- Limited agility and accessibility for data analysis.

- Data silos preventing effective information sharing.

- High costs due to server and license proliferation and IT complexity (shadow IT)

- Expensive scalability and lack of flexibility for new systems.

Key goals

Create a centralized repository for raw data accessible across departments

Implement incremental load processes and data governance procedures

Develop thematic, departmental, and business line-focused data marts

Build analytic applications tailored to specific business needs

Solution

Big Data Lakes are enterprise-wide data management platforms that store disparate data sources in their native format until queried for analysis. Unlike purpose-built data stores, data lakes consolidate raw data in its original form, eliminating information silos and enabling better data sharing. This approach reduces server and licensing costs, provides scalable and flexible storage, and ensures data accessibility for both programmers and business users

Adanto implemented a scalable and cost-effective cloud-based data lake infrastructure:

- Stored data in Amazon S3 Buckets for cost efficiency.

- Utilized parquet file format with HDFS/Hive for structured querying.

- Established a Hadoop/Spark cluster in AWS with autoscaling capabilities.

- Set up incremental data load processes using Apache Sqoop on an EMR cluster for daily data ingestion.

Let's connect

More Success Stories

![]() Thank you for your expertise and fast, quality delivery

Thank you for your expertise and fast, quality delivery![]()

Mike Perry

VP, Software Development

Ria Financial

Imagine walking into a supermarket where every aisle seems perfectly stocked with products you want. No empty shelves, no clutter of unpopular items. Behind this seamless experience is a complex decision-making process about what products to offer and how much space they deserve. For retailers, these decisions are tough and often based on guesswork or outdated information. But AI agents are changing that. By analyzing large amounts of data and continuously learning, these tools optimize product mix and shelf space in ways that were impossible before. This article explores how AI helps retailers make smarter choices, reduce waste, and meet customer demand more effectively.

Table of Contents

The Challenge of Merchandising

Retailers typically carry thousands of products. Each SKU competes for shelf space, which is a limited and costly resource. According to a Nielsen study, retailers lose nearly 10-15% of sales due to out-of-stock items or poor shelf placement. Meanwhile, excess inventory ties up capital and increases waste, especially for perishable goods. Traditionally, store managers use sales history and manual adjustments to plan product displays. But consumer preferences shift quickly, and competitors constantly change their offerings. This often results in overstocking slow movers or missing out on fast sellers, impacting both revenue and customer satisfaction.

How AI Agents Support Product Mix Decisions

AI agents dig deeper than basic sales reports. They analyze customer buying patterns, seasonal trends, promotional impacts, and even social media buzz. For example, an AI agent might detect an emerging trend for plant-based snacks before traditional methods catch on. These agents test various product combinations virtually, learning which mix drives the highest sales and margin. Retailers who use AI for product assortment have reported up to a 20% increase in sales and a 15% reduction in inventory costs. AI’s continuous learning means it adapts when new products arrive or when consumer habits shift, helping stores stay aligned with current demand.

Shelf Space Optimization Explained

Shelf space is a valuable asset that directly influences sales. Research by the POPAI Group found that 72% of purchase decisions happen in-store, making shelf placement crucial. AI agents recommend space allocation by weighing factors like product size, profitability, turnover speed, and customer preference.

For example, a fast-selling premium coffee brand may get more shelf space than a slow-moving generic. The AI can also adjust layouts quickly during promotional campaigns or new product launches. This flexibility reduces lost sales from poor product placement and improves overall store profitability.

Benefits for Retailers and Consumers

For retailers, the benefits are clear. AI reduces manual effort and guesswork, lowers inventory holding costs, and improves sales efficiency. Staff can focus on customer engagement and store experience rather than spreadsheet crunching. For consumers, this means shopping in stores that are better stocked and easier to navigate. They find the products they want more consistently, reducing frustration and improving satisfaction. Ultimately, smart merchandising creates a smoother shopping experience and a healthier bottom line.

Conclusion

Managing product mix and shelf space is difficult but essential for retail success. AI agents offer a smarter way to handle these challenges. They use data to make faster, more accurate decisions that keep stores stocked with the right products. This leads to better sales, lower costs, and happier customers. As retail becomes more competitive, adopting AI-based merchandising tools will help businesses stay ahead.

Want to use AI in your business?

Get in touch with the Adanto Software Team today to see how we can help.

Key Results

$1.5M

Annual savings from server consolidation & cloud migration

$400k

Annual costs savings from email workflow automation

$300k

Annual savings from AWS autoscaling that reduces unnecessary cloud resource use

Technologies used

- Java as core backend development for scalable workflows, API integration, and business logic.

- Jenkins for automated CI/CD pipelines for seamless builds, testing, and deployments.

- Kibana for visualized system logs and metrics for real-time monitoring and optimization.

- Drupal to Build a multilingual, user-friendly web interface supporting 19 languages.

- Amazon Web Services (AWS)

- SQS: Handled scalable subscription workflows.

- SNS: Delivered job alerts and notifications.

- S3 Bucket: Cost-effective storage for static assets.

- RDS: Managed relational databases for user data.

- KMS: Secured sensitive data with encryption.

- Docker for containerized deployments ensured consistency across environments.

- Oracle Eloqua Marketing Cloud Service

- Salesforce as centralized lead and subscription management

Challenge