FinTech

FinTech, or financial technology, is one of the fastest-growing sectors in the world, transforming the way we manage finances. From mobile payments and cryptocurrencies to artificial intelligence in banking, innovations in this field are revolutionizing traditional financial services, making them faster, safer, and more accessible. In this article, we will explore how FinTech impacts everyday life, the challenges facing the industry, and the opportunities that the future of financial technology holds.

Building digital-first financial solutions for customers that want modern banking experiences accessible anywhere, anytime, with any device

- Digital Account Management

- Money Movements (transfer, payments)

- Digital Account Aggregation

- Capital Markets & Trading

- Virtual Debit Card Management

- Financial Wellness

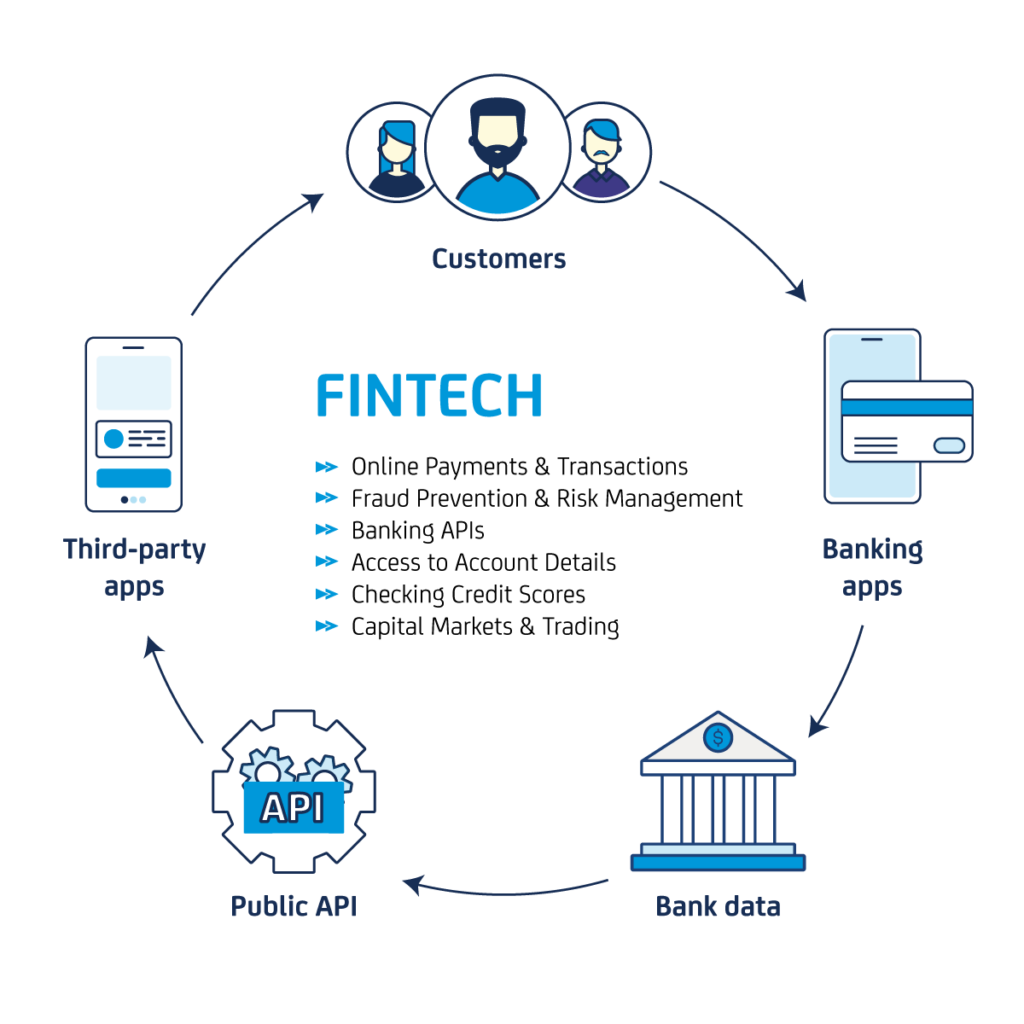

API integrations - as a FinTech enabler

Enable meaningful experiences through choice

Deploy our digital solution, our partner’s digital solutions or a trird way – the choice is yours.

Put customers at the center of your universe

Simplify everydar financial management with a range of products for anyone, anywhere

The power of the network

Choose from an ever-expecting ecosystem of innovate apps and roll them out super-fast

Personalization

Modular design and innovative widgets enable personalization

Security

Open up without creating gaps for bad actors to expoit

Integration

Wide range of integration options ensure rapid deployment

Our FinTech Services; BaaS Services, Digital Banking

We offer services for the FinTechs & BigTechs to help them embed financial services into third-party platforms and apps. We provision the retail or wholesale banking products (digital wallets) and services, as a service using an existing licenced institution’s secure, regulated infrastructure via modern API-driven platforms.

B2C Consumer BaaS Services

Embedded Banking

- account opening

- card issuing

Corporate API Banking

- real-time treasury management

- back-office automation

Embedded Payments

- seamless payment facilitation

- reconciliation at scale

B2B Wholesale (white-label) BaaS Services

- Create Debit Card (virtual)

- Enable / Disable Card

- Get Card Status

- Get Card Details

- Real-Time Approval of Transactions

- Request Apple Pay Token for Cards

94% of banks eyeing investment in modern payment tech,

to keep pace with fintech innovation

Our open banking services

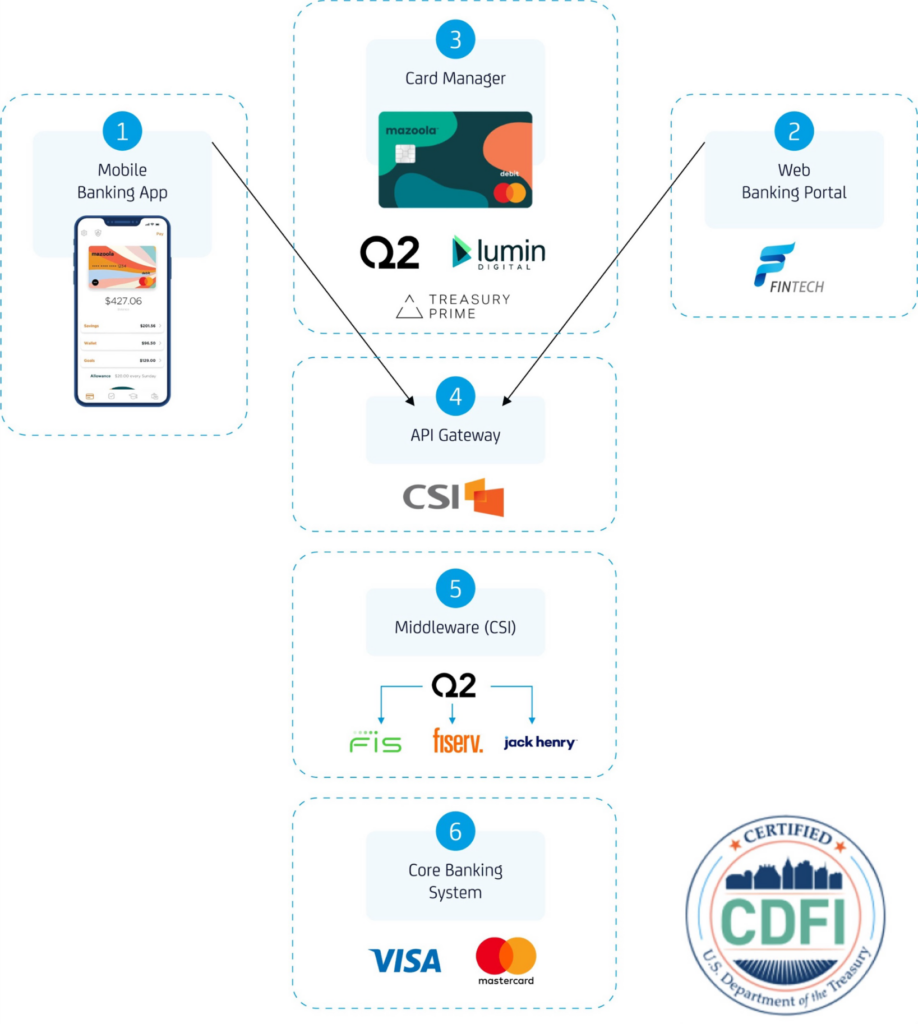

BaaS platform integration with Core Banking

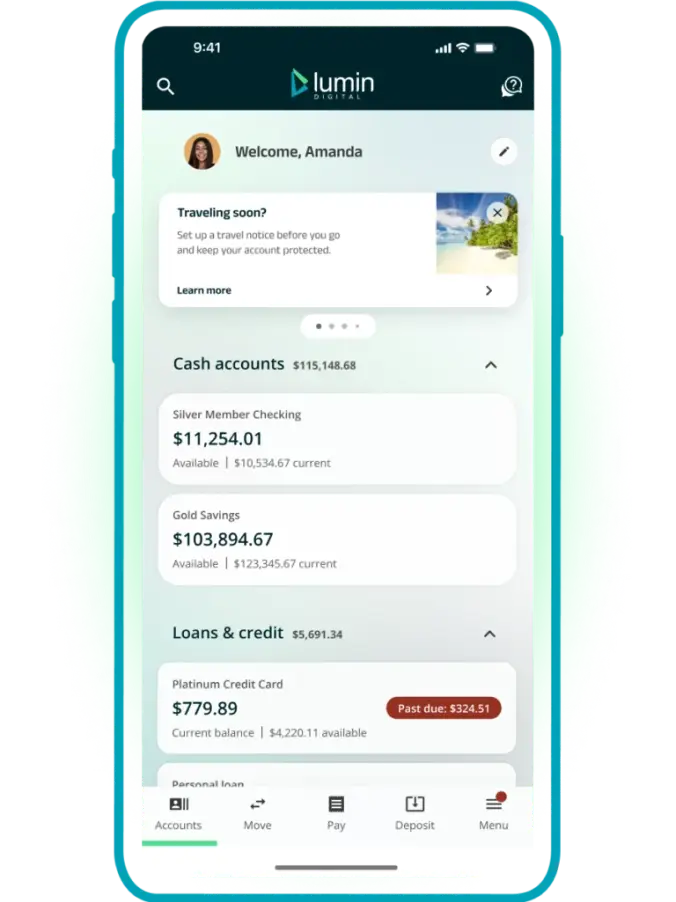

Mobile Banking App

Customers access card and banking services via mobile

Web Banking Portal

Online banking interface for customers

Card Manager

Handles card issuance, transations, authentication and security

API Gateway

Manages secure API calls between services

Middleware

CSI Integration Layer – Bridges Card manager, API Gateway and core banking

Core Banking System

Manages accounts, transactions and banking operations

Empowering the Next Generation: Family-Centric Fintech Solutions

We engineer secure, educational, and high-engagement digital banking platforms that bridge the gap between parents, children, and financial institutions.

Family Digital Wallet & Youth Banking

As Gen Z and Gen Alpha gain unprecedented spending power, traditional banking models must evolve. Adanto Software specializes in developing white-label family digital wallets that turn everyday transactions into financial literacy lessons. Our work — integrated within the REGO Payment Architectures team — has set the industry standard for secure, compliant, and parent-controlled youth banking.

Core Capabilities

- COPPA & GDPR Compliant Architectures

Data privacy is the foundation of youth banking. We build systems designed from the ground up to exceed federal and international child privacy laws, ensuring that minor data is isolated, encrypted, and handled with the highest level of regulatory scrutiny. - Parental Oversight & Real-Time Controls

We develop intuitive “co-pilot” experiences. Our solutions feature real-time transaction alerts, merchant-specific spending blocks, and automated allowance scheduling, giving parents peace of mind while granting children financial independence. - Gamified Financial Literacy

Move beyond static balance displays. We integrate goal-based savings modules, chore-tracking systems, and interactive educational content that incentivizes healthy financial habits through UX/UI best practices. - Seamless Core Integration

Our engineering team ensures that family wallet modules integrate smoothly with existing bank cores and digital banking platforms (such as Jack Henry, Q2, or Lumin Digital), allowing for rapid time-to-market without disrupting legacy systems.

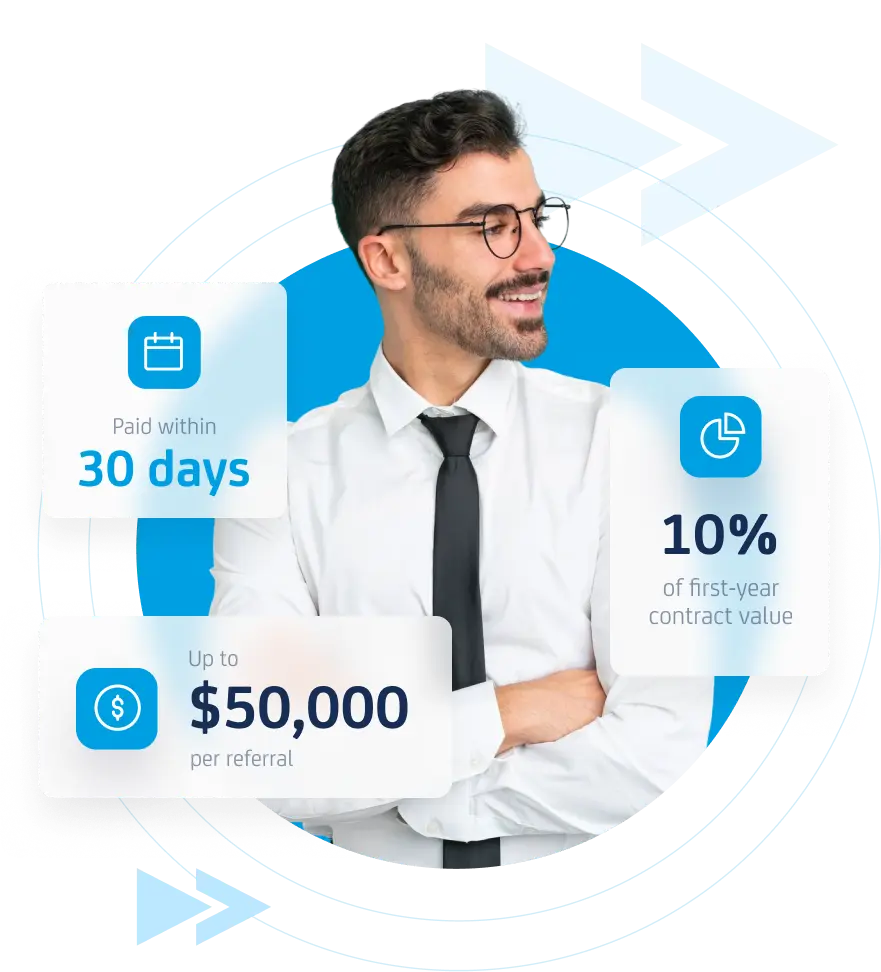

Why Partner with Adanto Software?

- Proven Engineering Pedigree

Our developers operate as an extension of your team, as demonstrated by our long-standing collaboration with REGO on high-profile launches like Camden National Bank’s Family Wallet. - Security-First Mindset

We specialize in patented age-verification technologies and “bank-grade” security layers that protect both the institution and the household. - LTV-Focused Design

We don’t just build apps; we build retention tools. By engaging users as young as five, we help financial institutions capture and keep customers for a lifetime.

Case Study: Camden National Bank

The Challenge: Launch a fee-free youth banking platform for a 150-year-old community bank.

The Solution: Adanto developers, working within the REGO team, delivered a turnkey, white-label mobile app and debit card platform.

The Result: A sophisticated, COPPA-certified digital wallet that positions the bank as a leader in Northern New England’s financial education space.

Developing for

the next generation?

Consult with our Fintech experts to see how we can integrate secure youth banking into your existing portfolio.

Transformed Products

Delivered new revenue generating products and services that were better tailored to customers’ individual and immediate needs, while leveraging our technology, delivery methods and global locations advantage to achieve this at very comepetetive prices.

Optimized Operations

Defined, built, managed and maintained mobile-first, cloud-based, serverless platforms for our customes with agility and scale to capitalize on new markets, geographies, ecosystems and business models while substantlally reducing costs.

Empowered Employees

Democratized and simplified access to a digital workspace for the employees of our clients, enabling unified, consistent, efficient and empowering experience equally for all to access systems, services, data and applications from anywhere.

Engaged Users

Helped aquire, engage and retain millions of customers as part of an ongoing practice of our clients’ anticipating their customers’ needs and keeping in touch with them to foster lasting relationships, loyalty and hence, business growth.

Ready to Transform

Your Business?

Get in touch with the Adanto Software Team today to see how we can help.

Don’t just take our word for it! Here’s what our clients have to say about working with us and the results we’ve delivered.

«Great knowledge and quick response in architecting the mobile app with its entire delivery data platform.»

«Glad that Adanto could get us started with IAM Automation Tool and Security metrics for our CISO and my Information Security Services Organization.»

«I am very excited about how Adanto has helped Circle Graphics to utilize the eCommerce and Magento expertise and very efficient deployment model.»

«I want to thank the entire Adanto team for all your efforts and help with ITMCC and Robert Half. I want to thank the team for your efforts on the project, providing the resources so quickly and being so flexible and nimble during the development cycle. Adanto is our go-to partner for our new initiatives in our Marketing vertical.»

«Maciek and the rest of Adanto team were great to work with. Thank you!»

«You have truly saved our product from a near demise caused by an incompetence of a far-shore supplier.»

«The team presented a solid strategy with beacons for our mobile application.»

«Adanto has performed the project on time and to our complete satisfaction. We have achieved our goal of improved visibility in our global call centers and could fix issues much quicker for our internal clients.»

«Adanto's speed in responding to concerns is great. You are really great to work with.»

«We have been continually reassured of Adanto’s versatile portfolio of expertise while tasked with deploying a major multi-national pharmaceutical company’s Secure Transit VPC across multiple geographic regions spanning two continents. Adanto’s ability to work with geographically dispersed teams and deliver on the customer’s terms in multiple timezones is a true differentiator few engineering services company’s can offer.»

«Adanto has helped us be more productive and monitor costs of an AWS cloud.»

«The Adanto team was of the first groups of developers I started working with at Sensaria and really one of the constants during my time here. Thank you for everything over the years - most notably your flexibility and teamwork with the on-shore team, and teaching us key Polish terms along the way. I'm happy to say that the concept of "Little Friday" has spread around Sensaria!»

«Thank you for your help in migration to the Dell infrastructure.»

«Adanto and especially Maciek were instrumental in getting our iTrack Reporting Workstream Project on track and successful, beyond expectations. Thank you! The whole team was wonderful to work with on-site in San Ramon, CA and off-site from Poland.»

«Adanto has added great value to Brett, our CTO, and his team to get us off the ground in E-commerce.»

«Adanto has proven to be an invaluable strategic partner for Cloudify. Having spent many years working with various engineering services company’s, Adanto excels not only in the quality and speed of services they deliver but also in their commitment to fairness and transparency. Always giving the best possible recommendations to the customer while remaining eager to facilitate work in the most demanding or challenging of environments.This consistent balance of rapidly available expertise, sincerity and flexibility makes them our #1 go to partner!»

«You were awarded a contract based on your ability to deliver unmatched technical innovation skills, solid track record of stable and predictable results, offered via progressive people and results-oriented culture.»

«Adanto SOC consultation and proposal was very compelling and on par with the GE proposal. Your security engineers are very capable.»

«I have had the pleasure of collaborating with Mike on several projects as a client during my career. Adanto stands out as a premier IT professional software services and solutions company. I can attest to their dedication to delivering innovative and robust solutions tailored to the unique needs of their clients. The software development teams at Adanto are not only technically proficient but also deeply committed to achieving the best outcomes for their clients. They are incredibly fun and engaging to work with. Their proactiveness and adaptability helps make Adanto a trusted business advisor and innovation partner.»

«The quality and skills of your engineers are very impressive. You have helped us accelerate the delivery of our fin tech prototype that has turned heads at Zions Bank.»

«We are tremendously pleased with Adanto's quality and speed of delivery for AWS Security engineering services to our clients in the Financial Services sector. Your expertise was sorely needed by our organization. I only wish we’d engaged you earlier!»

«Thank you for putting together with Alvin the architecture, and plan to make it easy for potential customers who are using Shopify for their eCommerce platform to use Fujifilm's personalization engine by creating a plug-in extension.»

«I am giving my highest recommendation for Adanto Software. Having dealt previously with a tech who answered in a day or two, Adanto’s responses were truly impressive.»

«Thank you for the design plan of Fujifilm E-commerce Plug-ins integration of our Simple Ordering Platform (SOP) with Shopify and MediaClip that adds a product builder functionality in the Shopping Cart, then submit it via SPA API.»

«We know how fast Adanto has created an application for Robert Half that intergates our patented Quill technology and so we are very convinced how strong your team is.»

«We absolutely appreciate all of Adanto's help in getting Outside Financial off the ground.»

«Your engineers have been doing great and are very proactive.»

«Thank you for your expertise and fast, quality delivery!»

«Thank you Adanto Team for the foundational architecture decisions and deliveries to get us going with web alerts!»

«The Adanto Software team has come through for us and at the lightening speed!»

«The Adanto Software team with Piotr really rocked!»

«Adanto has helped us in our first phase of creating DataLake and gathering data in centralised location.»

«Adanto was pivotal in getting our iTrack Reporting Workstream Project on track and successful.»

«Adanto has helped us be more productive and monitor costs of an AWS cloud.»

«The Adanto team has exceeded my expectations, delivered solid results and offered very valued support in place of several previous suppliers who have only left confusion and lots of bugs.»

«We all greatly appreciate the time you've spent with Adanto and for your various software services.»

«Adanto has provided superior software engineers we needed to complete our multiple data migration and integration efforts.»