Financial institutions are currently navigating a significant demographic shift. As Gen Z and Gen Alpha enter the economy, the traditional brick-and-mortar approach to banking is being replaced by a demand for integrated, educational, and mobile-first experiences. Camden National Bank’s recent launch of “Family Wallet” is not just a product update; it is a strategic move to capture market share in the burgeoning “family fintech” sector.

For software providers and financial leaders, this move highlights a critical intersection of UX design, educational psychology, and long-term customer retention. By partnering with REGO Payment Architectures (REGO), Camden National is shifting from a passive repository of wealth to an active participant in a child’s developmental journey.

Table of Contents

The Shift Toward Family-Centric Fintech

For years, the “youth account” was a dormant savings vehicle with a low interest rate and a passbook. Today, the landscape is defined by real-time notifications, automated allowance scheduling, and parental controls. Camden National Bank has recognized that to remain relevant, they must compete with fintech giants, which have successfully moved into the parental space.

The Family Wallet platform removes the barrier of monthly fees, which is a significant friction point for parents. By offering a digital-first experience that mirrors adult banking — complete with a debit card and mobile app — they are effectively onboarding the next generation of consumers before they reach legal adulthood. This is a high-lifetime-value (LTV) strategy. When a child learns the interface of a specific banking app at age 10, the likelihood of them switching to a competitor at age 18 decreases significantly.

The REGO Partnership: Privacy as a Competitive Advantage

A standout element of this launch is the technological backbone provided by REGO Payment Architectures. In a climate where data privacy is a top-tier concern for parents and regulators alike, Camden National’s choice of partner is telling.

REGO provides a white-label family digital wallet platform that is specifically built to exceed the requirements of the Children’s Online Privacy Protection Act (COPPA) and GDPR. This isn’t just a technical detail; it’s a trust-building mechanism. By leveraging REGO’s patented technology for age verification and data safety, Camden National can offer a “bank-grade” secure environment that third-party fintech startups often struggle to match. This partnership allows a community bank to deliver a sophisticated, turnkey solution that prioritizes child safety without the massive overhead of building a proprietary system from scratch.

REGO’s Award-Winning

Digital Wallet for Kids and Families

The technical sophistication of the Family Wallet platform is the result of a deep engineering collaboration. Adanto Software developers worked as a core extension of the REGO team to build and refine the secure architecture that powers this solution. By combining REGO’s patented privacy frameworks with Adanto’s expertise, we were able to deliver a platform that is as safe as it is intuitive.

Core Features of the Family Wallet Platform

The platform is designed to facilitate a “learn-by-doing” environment. It isn’t just a place to store money; it’s a sandbox for financial decision-making. Key components include:

- Parental Oversight: Parents can monitor transactions in real-time, providing a safety net that allows for independence without total autonomy.

- Chore and Allowance Integration: The app allows parents to assign tasks, teaching the direct link between effort and financial reward.

- Goal-Based Savings: The UI encourages users to categorize funds for specific purposes, teaching the concept of delayed gratification.

- Zero-Fee Structure: By eliminating maintenance fees, the bank ensures that small balances aren’t eroded, which is essential for maintaining the trust of young savers.

The Psychology of Early Financial Education

Early exposure to financial management changes the cognitive framework through which children view money. Research suggests that financial habits are largely formed by age seven. By introducing a digital platform during these formative years, Camden National is leveraging “just-in-time” education — providing information exactly when the user is making a transaction.

This approach moves away from theoretical classroom learning and toward experiential learning. When a child sees their balance drop after a purchase, the “pain of paying” is visualized digitally. This immediate feedback loop is more effective than any textbook in teaching fiscal responsibility.

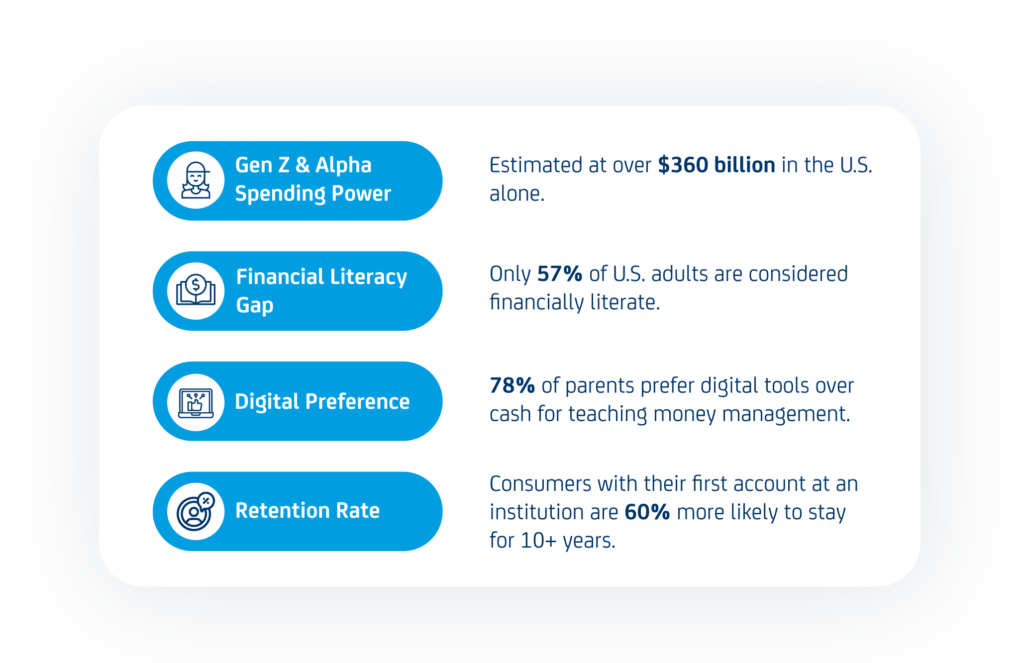

To understand the scale of this opportunity, we must look at the current market data regarding youth spending and digital banking adoption.

According to recent industry reports, parents are increasingly looking for “all-in-one” solutions that live within their existing banking relationship. By integrating REGO’s secure architecture, Camden National addresses the 43% of parents who report feeling “overwhelmed” when trying to teach their children about money.

Conclusion

The launch of Camden National Bank’s youth platform is a clear indicator that the future of banking is educational. By providing the tools for the next generation to practice financial management in a controlled, digital environment, they are building a more resilient customer base.

For the software industry, the message is clear: UX is no longer just about ease of use; it is about empowerment. As we move further into a cashless society, the responsibility of teaching the value of a dollar falls on the platforms we build. Camden National, supported by REGO’s robust privacy framework, has set a high bar for community banks nationwide.

At Adanto Software, we take immense pride in our collaboration with the REGO team to deliver this digital banking milestone, empowering households with sophisticated financial education and granular parental controls.

Developing for

the next generation?

Consult with our Fintech experts to see how we can integrate secure youth banking into

your existing portfolio.