In finance, compliance is not optional. It’s a requirement—and a costly one. Banks, insurers, and investment firms spend billions each year to keep up with changing regulations. And the pressure is only growing.

But there’s a shift happening. Agentic AI is quietly changing how compliance work gets done. It’s not about replacing compliance officers. It’s about giving them smarter tools to handle the growing complexity, faster and with fewer errors.

This article explores how Agentic AI is helping financial institutions automate compliance. We’ll look at what’s driving the need, how the technology works in real situations, and what to consider before moving forward.

Table of Contents

The Rising Cost of Compliance

Regulatory pressure has increased steadily since the 2008 financial crisis. From anti-money laundering (AML) to data privacy laws, institutions face a maze of rules—many of which change frequently and differ across regions.

In 2023, major banks in the U.S. spent an average of 10–15% of their operating budget on compliance. It’s not just about cost. It’s about the time lost to manual reviews, document collection, and reporting. Mistakes are expensive too. Fines for non-compliance have totaled over $400 billion globally since 2009.

The current model isn’t sustainable. The pace of regulatory change is faster than human teams can reasonably handle. That’s why automation is no longer a “nice to have.” It’s necessary.

Why Traditional Methods Fall Short

Compliance teams often rely on rule-based systems. These are good for tasks with clear, static logic. But regulations aren’t static. They change. They differ between jurisdictions. They sometimes contradict each other.

Manual processes add another layer of risk. Humans miss things—especially when reviewing hundreds of pages of legal text or thousands of transaction records. And as data volumes grow, human teams can’t scale fast enough to keep up.

Spreadsheets and legacy systems can’t carry this weight anymore. They’re too rigid. They’re slow to adapt. They don’t learn or improve over time.

How Agentic AI Fits In

Agentic AI changes the approach. Instead of following fixed rules, it can interpret patterns, reason through steps, and act independently within set boundaries. It’s goal-oriented. It doesn’t just process data—it understands tasks in context and decides how to complete them.

In compliance, that means:

- Reading regulations and extracting relevant obligations

- Monitoring transactions in real time to flag suspicious activity

- Checking policies against regulatory frameworks

- Creating audit trails without manual input

- Filling out reports with accuracy and traceability

Agentic AI doesn’t operate in isolation. It works with people. A compliance officer may set the goal—like checking transactions for sanctions risk—and the AI figures out the best steps to take, asks for feedback, and updates its process over time.

This makes it more flexible than past automation tools, but also more accountable than traditional AI models that function like black boxes.

Real-World Applications

AML Transaction Monitoring

A global bank used Agentic AI to overhaul its AML process. Instead of flagging transactions based on fixed thresholds, the AI evaluated behavior over time, cross-checked it with external data sources, and adapted its logic as new risk patterns emerged. False positives dropped by 40%. Investigators could focus on real threats, not noise.

Regulatory Change Management

A European investment firm used Agentic AI to track regulatory updates across 15 jurisdictions. The system scanned official documents, matched them to internal policies, and alerted the legal team when adjustments were needed. What used to take weeks now happens in hours.

KYC Automation

A fintech startup applied Agentic AI to its KYC onboarding flow. Instead of fixed forms, the AI led dynamic interviews with customers, asked only the necessary questions, and validated documents in real time. This reduced drop-off rates and cut verification time by 70%.

Challenges and Risks

This isn’t plug-and-play technology. There are serious risks to consider:

- Oversight: Agentic systems need constant human supervision. They’re smart, but not infallible.

- Auditability: Regulators require clear, traceable records. The AI must show why it made a decision.

- Bias and fairness: If the training data is flawed, the system can make biased or inconsistent calls.

- Data privacy: Handling sensitive financial and customer data demands strict safeguards.

Trust is built through transparency, testing, and clear limits on what the system is allowed to do.

What to Do Next

If you’re exploring Agentic AI for compliance, start small. Identify a specific pain point—like transaction monitoring or document review—and build a pilot with clear goals.

Make sure your compliance, legal, and tech teams work together from the start. This isn’t just a software project. It’s a shift in how work gets done.

Finally, choose a vendor or partner with deep experience in both AI and finance. The right expertise makes a big difference in managing risk and getting results.

Conclusion

Compliance isn’t getting easier. The volume of regulations, the speed of change, and the cost of mistakes are all going up. Traditional tools can’t keep up.

Agentic AI offers a smarter way forward. Not by replacing people, but by helping them work faster, smarter, and with more confidence. It can read, reason, act, and improve. That’s a big shift for finance—and one that’s already underway.

Want to use AI in your business?

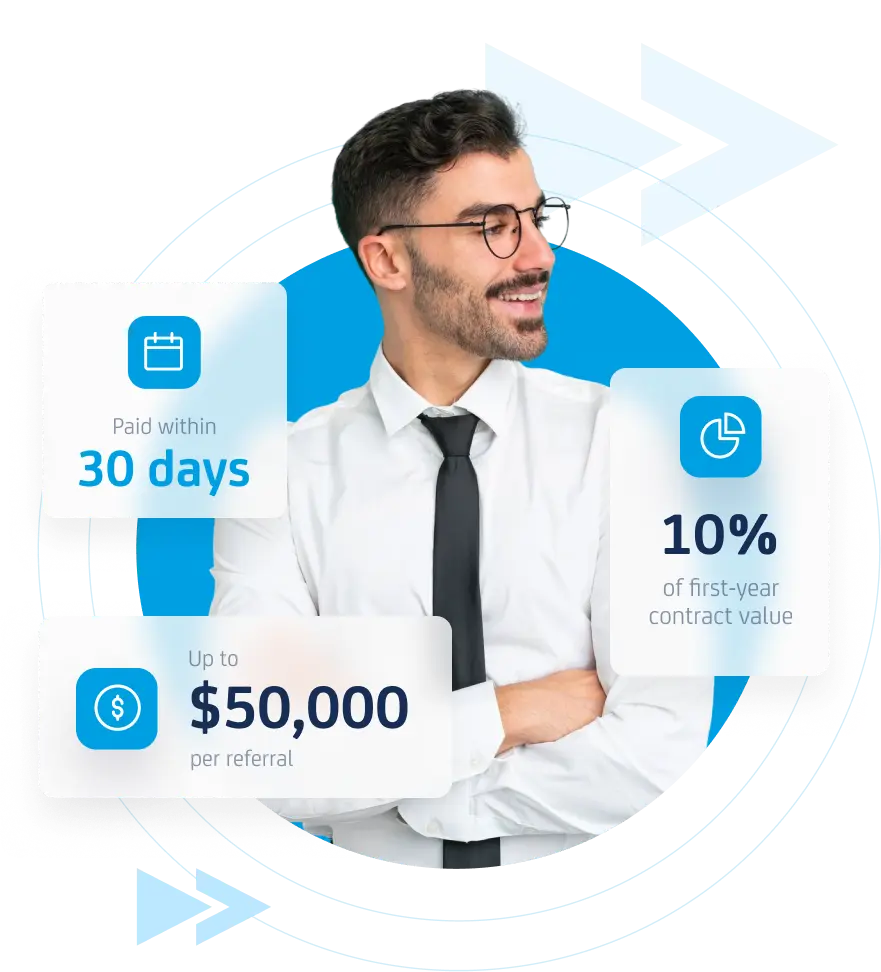

Get in touch with the Adanto Software Team today to see how we can help.