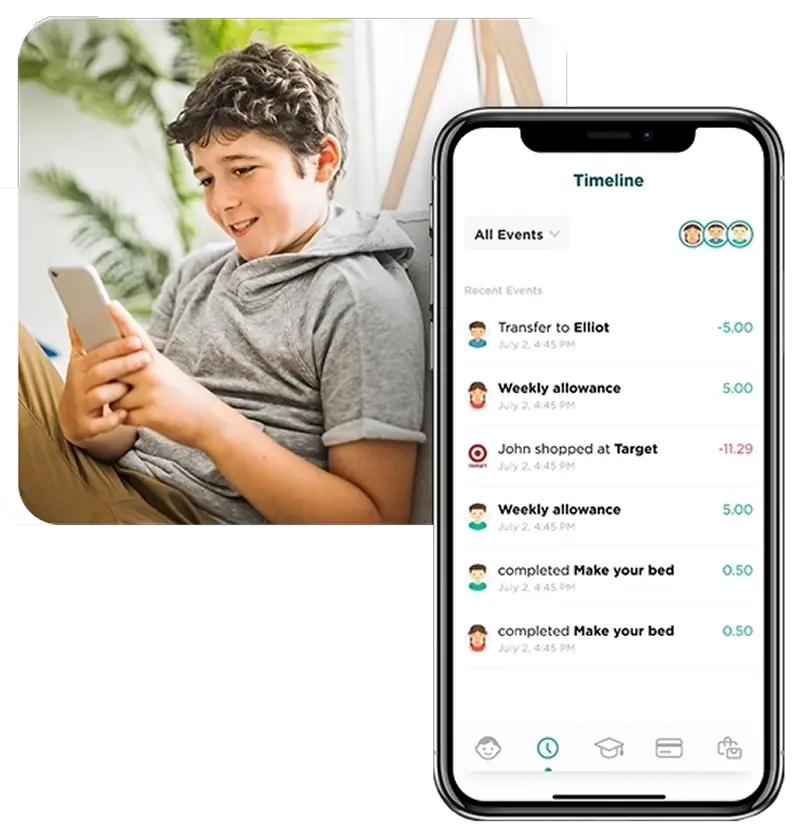

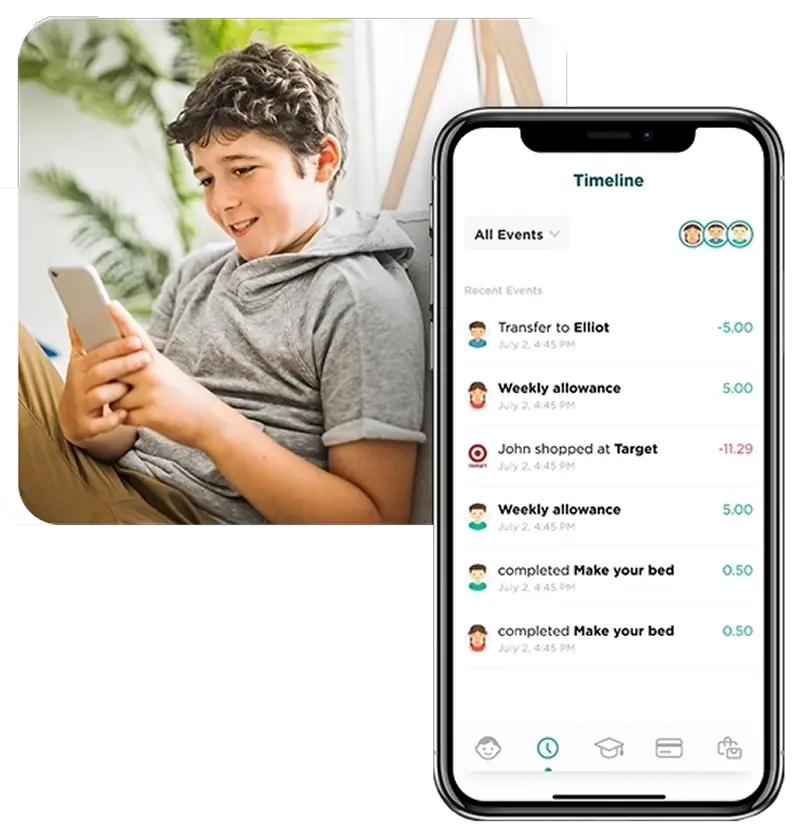

The Award-Winning Digital Wallet for Kids and Families

Digital payments are a part of everyday life – but until recently, they weren’t built with kids or families in mind. REGO set out to change that. They had a vision to empower children and teens with real-world financial tools in a secure, parent-supervised environment.

To make it happen, they needed a COPPA-compliant fintech platform – with banking-level security, intuitive user experience, and future-ready architecture.

About REGO

REGO Payments Architectures, Inc. is a digital payments company that delivers banking solutions aimed at enhancing financial literacy for families and children. Their flagship product, Mazoola, is a digital e-wallet platform designed to facilitate spending, savings, investing, and peer-to-peer transfers in a safe, parent-supervised environment.

What makes Mazoola unique is its patented, privacy-first technology. It is the first and only GDPR kids-compliant digital wallet, ensuring that children’s personal information is protected from third-party marketers. This focus on security and privacy is what sets Mazoola apart in the digital payments industry.

Adanto Software played a pivotal role in this success by becoming REGO’s strategic product development partner. Adanto delivered a modernized, scalable, and secure platform, successfully re-architecting the backend, refactoring the code, and integrating with 21 best-of-breed financial services in a remarkably short period. Their work enabled REGO to quickly relaunch Mazoola and capitalize on the growing demand for child privacy solutions.

About REGO

REGO Payments Architectures, Inc. is a digital payments company that delivers banking solutions aimed at enhancing financial literacy for families and children. Their flagship product, Mazoola, is a digital e-wallet platform designed to facilitate spending, savings, investing, and peer-to-peer transfers in a safe, parent-supervised environment.

What makes Mazoola unique is its patented, privacy-first technology. It is the first and only GDPR kids-compliant digital wallet, ensuring that children’s personal information is protected from third-party marketers. This focus on security and privacy is what sets Mazoola apart in the digital payments industry.

Adanto Software played a pivotal role in this success by becoming REGO’s strategic product development partner. Adanto delivered a modernized, scalable, and secure platform, successfully re-architecting the backend, refactoring the code, and integrating with 21 best-of-breed financial services in a remarkably short period. Their work enabled REGO to quickly relaunch Mazoola and capitalize on the growing demand for child privacy solutions.

Key Results

5 Weeks

The time it took for the first Mazoola’s Payment Platform to integrate.

21 Services

The total number of best-of-breed financial services integrated with Mazoola.

+466%

REGO’s stock value increased (as of Dec’2024) since Adanto’s first release of its first product version on the market.

Technologies Used

Cloud Platform Hosting: Azure

iOS Mobile App: Swift

Android Mobile App: Java

Frontend Services: React Native

Backend Services: C#/.NET

Database: Microsoft SQL Server

Web App: Node.js

Password Vault: Dashlane

DevOps Tools: Azure Repos, Boards, Pipelines

Testing: Jasmine

The Challenge

In 2012, Rego Payments Architectures, Inc. was a pioneer in the children’s digital privacy space. While their early entry secured valuable patents, it also put them far ahead of the market curve. At the time, public concern over children’s online privacy was minimal, and after four years of development, the product failed to gain traction and was pulled from the market.

Fast forward to mid-2020 public awareness of digital privacy had exploded, creating the perfect opportunity for Mazoola’s relaunch. Rego’s new goal was audacious: get the platform back on the market by the end of the year. That required significant re-engineering and a new, reliable development partner.

Key goals

Financial Integration: Develop a cloud-based digital wallet that could meet high standards and integrate it with financial systems.

Scalable Architecture: Build a highly scalable, cloud-native architecture using advanced security measures and AI-driven fraud detection to support seamless and safe user experiences.

Seamless Payments: Enable seamless digital payments to support online and in-store purchases via virtual cards, merchant category filtering, and integrations with popular platforms like Apple Pay.

Future-Proof Functionality: Develop API integrations to expand functionality and interoperability with third-party financial tools and platforms and create a modular framework that allows for future expansion, including partnerships with educational or banking services.

The Solution

Mazoola’s technical solution represents a sophisticated blend of fintech innovation and strict regulatory adherence, offering a safe, scalable, and family-friendly digital wallet experience.

Cloud-Native Architecture: The platform features regional redundancy and a high-availability, multi-region architecture built on Azure. This design ensures global scalability, low latency, and high throughput to handle large volumes of transactions.

Secure Wallet Infrastructure: The platform provides a highly secure wallet infrastructure with tokenized virtual cards for both online and in-store purchases. It also includes real-time fraud detection (using platforms like Sardine) and multi-layer authentication to protect users.

Seamless Payment Integration: The solution is compatible with major payment networks and seamlessly integrates with popular platforms like Apple Pay and Google Pay to enable easy digital payments.

Extensibility: A suite of RESTful APIs provides a modular framework for integration with best-of-breed third-party platforms and financial services. This extensibility allows for future expansion, including partnerships with educational or banking services, and helps Rego to avoid vendor lock-in.

Compliance and Privacy: The platform is designed to meet the strictest regulatory standards, including COPPA and GDPR. It uses anonymized data handling for children’s Personally Identifiable Information (PII) and employs end-to-end encryption to ensure maximum privacy.

Parental Control and User Management: The solution offers robust parental controls and user management features, including role-based access with distinct permissions and real-time transaction monitoring.

The Challenge

In 2012, Rego Payments Architectures, Inc. was a pioneer in the children’s digital privacy space. While their early entry secured valuable patents, it also put them far ahead of the market curve. At the time, public concern over children’s online privacy was minimal, and after four years of development, the product failed to gain traction and was pulled from the market.

Fast forward to mid-2020 public awareness of digital privacy had exploded, creating the perfect opportunity for Mazoola’s relaunch. Rego’s new goal was audacious: get the platform back on the market by the end of the year. That required significant re-engineering and a new, reliable development partner.

Key goals

Financial Integration: Develop a cloud-based digital wallet that could meet high standards and integrate it with financial systems.

Scalable Architecture: Build a highly scalable, cloud-native architecture using advanced security measures and AI-driven fraud detection to support seamless and safe user experiences.

Seamless Payments: Enable seamless digital payments to support online and in-store purchases via virtual cards, merchant category filtering, and integrations with popular platforms like Apple Pay.

Future-Proof Functionality: Develop API integrations to expand functionality and interoperability with third-party financial tools and platforms and create a modular framework that allows for future expansion, including partnerships with educational or banking services.

The Solution

Mazoola’s technical solution represents a sophisticated blend of fintech innovation and strict regulatory adherence, offering a safe, scalable, and family-friendly digital wallet experience.

Cloud-Native Architecture: The platform features regional redundancy and a high-availability, multi-region architecture built on Azure. This design ensures global scalability, low latency, and high throughput to handle large volumes of transactions.

Secure Wallet Infrastructure: The platform provides a highly secure wallet infrastructure with tokenized virtual cards for both online and in-store purchases. It also includes real-time fraud detection (using platforms like Sardine) and multi-layer authentication to protect users.

Seamless Payment Integration: The solution is compatible with major payment networks and seamlessly integrates with popular platforms like Apple Pay and Google Pay to enable easy digital payments.

Extensibility: A suite of RESTful APIs provides a modular framework for integration with best-of-breed third-party platforms and financial services. This extensibility allows for future expansion, including partnerships with educational or banking services, and helps Rego to avoid vendor lock-in.

Compliance and Privacy: The platform is designed to meet the strictest regulatory standards, including COPPA and GDPR. It uses anonymized data handling for children’s Personally Identifiable Information (PII) and employs end-to-end encryption to ensure maximum privacy.

Parental Control and User Management: The solution offers robust parental controls and user management features, including role-based access with distinct permissions and real-time transaction monitoring.

Key Results

5 Weeks:

The time it took for the first Mazoola’s Payment Platform to integrate.

21 Services:

The total number of best-of-breed financial services integrated with Mazoola.

+466%:

REGO’s stock value increased (as of Dec’2024) since Adanto’s first release of its first product version on the market.

Technologies Used

Cloud Platform Hosting: Azure

iOS Mobile App: Swift

Android Mobile App: Java

Frontend Services: React Native

Backend Services: C#/.NET

Database: Microsoft SQL Server

Web App: Node.js

Password Vault: Dashlane

DevOps Tools: Azure Repos, Boards, Pipelines

Testing: Jasmine

Don’t just take our word for it! Here’s what our clients have to say about working with us and the results we’ve delivered.

«Adanto has done a nearly impossible task of replacing the previous banking-as-a-service provider with a new one SYNAPSE in just five weeks; for a platform they had never seen before. Adanto pulled it off.»

Mark Vanderbeek,

CTO Rego Payment Architectures, Inc.

«Adanto has done a nearly impossible task of replacing the previous banking-as-a-service provider with a new one SYNAPSE in just five weeks; for a platform they had never seen before. Adanto pulled it off.»

Mark Vanderbeek,

CTO Rego Payment Architectures, Inc.